What’s scarier for Canadian communities — floods, or flood maps?

When maps showing areas most likely to flood are outdated, it puts people and property...

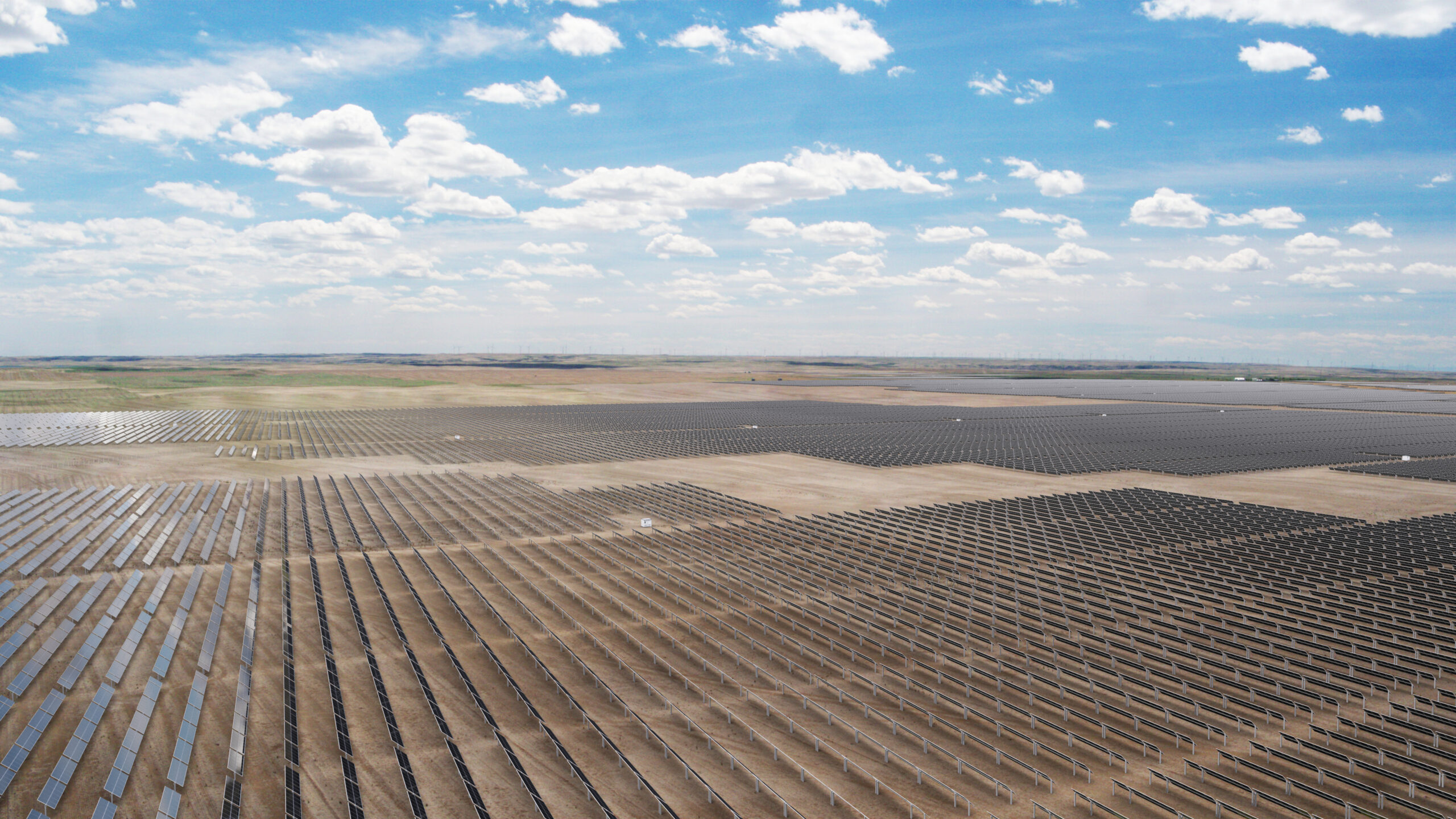

In recent years, renewable energy development has been surging in Alberta, a place where the electricity grid until very recently was dominated by coal — a fossil fuel with notoriously high emissions that is on track to be completely phased out this year. Even as natural gas fills that gap and now fuels more than 60 per cent of the grid, renewables have climbed from a relative footnote to generating almost 20 per cent of Alberta’s electricity.

But that nation-leading momentum came to a sudden halt this summer when the United Conservative Party government announced a surprise and immediate seven-month pause on approving new renewable energy projects.

The government directed the Alberta Utilities Commission, which regulates electricity, gas and water utilities, to hold an inquiry and prepare recommendations for new regulations in those seven months.

That decision, seemingly made without consultation, could impact the pace of future development, freeze or cancel projects already lined up for approval and hamper Alberta’s legislated target of having 30 per cent of all electricity generated in the province come from renewables by 2030.

So what exactly happened and what could it mean for Alberta’s renewable energy sector?

On Aug. 3, the United Conservative Party (UCP) government in Alberta surprised just about everyone by announcing it was immediately ordering a pause on all new renewable electricity generation projects, effectively immediately.

It also said it was ordering the Alberta Utilities Commission to start an inquiry examining future rules for new projects, specifically around impacts on agricultural land and viewscapes, requirements for post-project cleanup — including a security deposit to cover costs — projects on Crown land and the impact of Alberta’s rapid renewable energy growth on the overall power grid.

“We are proud of our leadership in responsible renewable energy development and we are committed to its continued growth,” Nathan Neudorf, minister of affordability and utilities, said in a news release announcing the moves. “This approach will provide future renewable investments with the certainty and clarity required for long-term development.”

The pause directly impacts 13 projects currently in the approval process through the commission, but an analysis by the Pembina Institute shows there are 118 projects at some stage of development, including those which haven’t gone to the Alberta Utilities Commission yet. It pegs the investment tied to building those projects at $33 billion.

A seven-month pause could make some of those developers reconsider their plans, particularly if the economics of a project shift once the inquiry is wrapped.

In late August, the commission announced it would continue to process applications already submitted prior to the government’s pause, but would not give final approval until the inquiry is complete.

Initially, the government said the moves were in “direct response” to a letter from the utilities commission noting issues around farmland and reclamation as well as “concerns raised from municipalities and landowners.”

That announcement came with links to the commission’s letter and to a letter from the Alberta Electricity System Operator, which oversees the grid, and which the government said supported the pause.

The problem was the commission letter did not ask for a pause and the operator letter simply thanked the government for letting it know there would be a pause. Both letters were dated July 21, meaning the commission letter purportedly asking for a pause (which it didn’t) was written the same day the operator letter thanked the government for informing it of the Alberta moratorium on renewable energy.

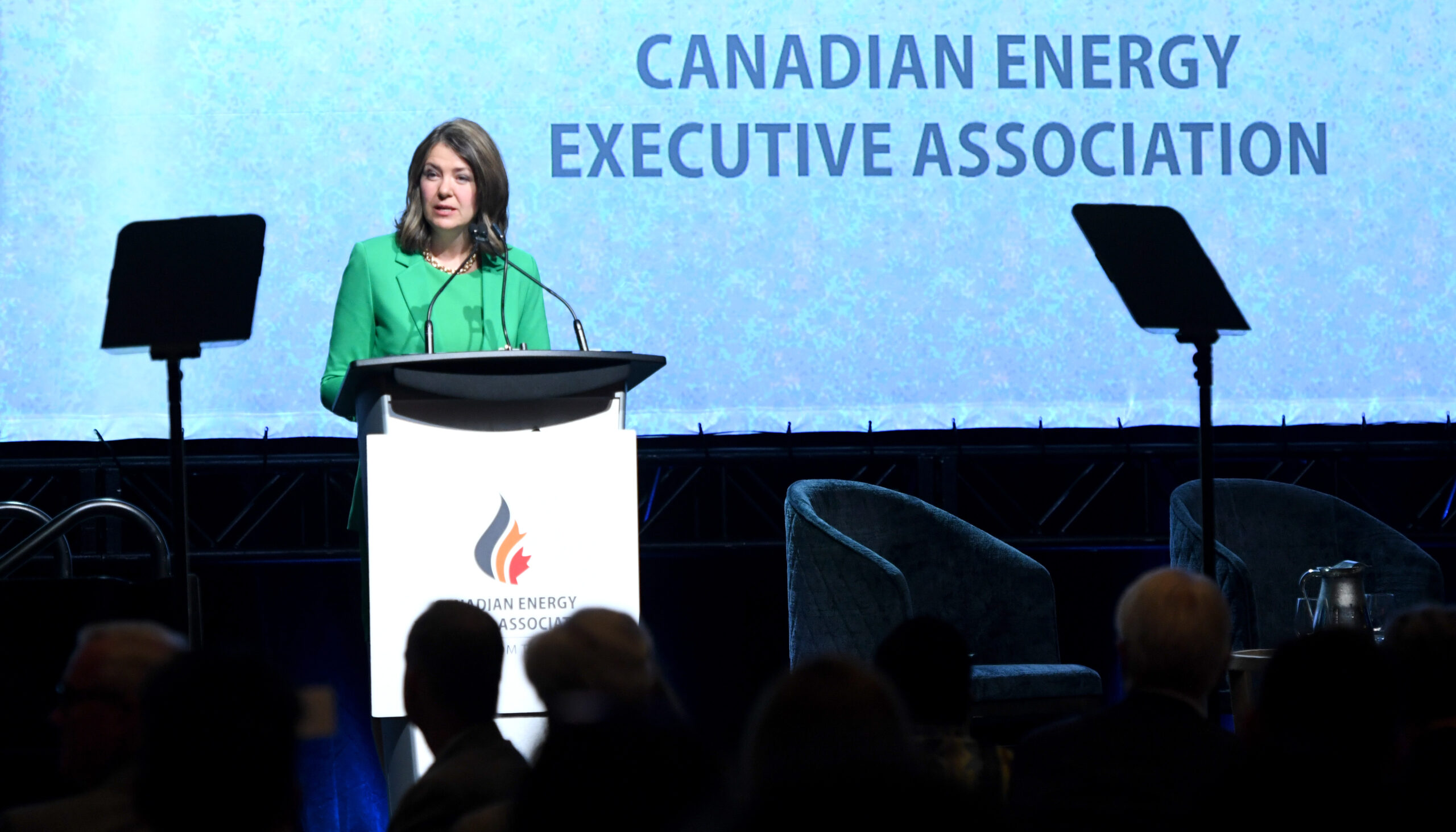

When pressed by reporters on the confusing timing and contradictions, Premier Danielle Smith said people should have seen the changes coming because she expressed concern about the pace and impact of renewable development at a Rural Municipalities of Alberta Conference in the spring.

Rural Municipalities of Alberta has been advocating for changes to the regulations and approval processes for renewable projects, but says it also did not ask for a pause.

The impact of the pause will depend on the outcome of the inquiry, the commission’s eventual report and, ultimately, what the government decides to do. At this point, there’s a lot of uncertainty.

There are questions about what new requirements could impact projects already in the approval process and about what new rules could be imposed after the inquiry.

“I think that by going forward with an unprecedented moratorium, rather than using the standard regulatory processes that we have and have used for reviews of other industries without pausing development — that turns this into more of a political question,” Jorden Dye, the acting director of the Business Renewables Centre Canada, said in an interview.

In the end, whether projects currently underway will be completed will come down to the impact on each project’s budget and the price of the power it eventually generates, Dye said. Alberta has benefited from its deregulated market, which allows companies including Amazon and Canadian Natural Resources Ltd. to sign contracts — known as power purchase agreements — with renewable developers to purchase power or offsets to reduce their emissions.

“A large corporation might be doing this for environmental, social and governance goals, but it still has to make financial sense,” he said.

One industry insider said a lot will depend on the government and commission hitting deadlines and producing clear directives. The Narwhal agreed not to name the insider so they could speak freely despite the political uncertainty. There are a lot of companies wondering whether to move forward with proposals now or wait to see what the rules will be, they said.

“People still are wondering: what does the process look like by the time I make my way through it?” they said.

That same insider said they’ve had reassurances from the government that it wants to get through the process on time and get projects moving again, but questions the commitment.

“The thing that we keep hearing is, ‘the end of the pause is written in regulation, and so you can take that to the bank,’ ” they said.

But that doesn’t reassure them. They note the pause was the result of a unilateral cabinet decision and its end could be extended in the same way.

Many worry uncertainty and possible delays will lead investors to look elsewhere, particularly to the U.S. after the introduction of the Inflation Reduction Act last year, which included massive incentives for renewable generation.

“You basically have this combination of this new uncertainty being injected into the system in Alberta at exactly a time when other places are rather ramping up their efforts and attractiveness to have more renewable energy projects happen in those regions,” Sara Hastings-Simon, director of the sustainable energy development program at the University of Calgary, said in an interview.

The consensus appears to be: time will tell.

“I think it certainly will have some impact on renewable energy development,” Hastings-Simon said. “The scale of it, of course, remains to be seen.”

Since the pause was announced, the commission has been releasing information in jumps and starts including that it would continue to review applications without approving them, and some more specifics on what will be addressed.

Dye said this isn’t the best approach, and the ambiguity about what exactly the inquiry will look like is causing the renewable sector stress. But a clearer picture is starting to emerge.

On Sept. 6, the Alberta Utilities Commission released a bulletin outlining what new applicants for renewable projects will have to undertake over and above the existing rules. It also says current applicants “may be required to respond to these interim information requirements.”

It calls on companies to provide details on the kind of agricultural land that will be impacted by their projects, what disturbances to the ground are planned and the possibility of agricultural activities taking place alongside the project.

It also calls for quantification of the reclamation process and how security deposits will be spent.

But perhaps the most opaque new requirement involves how a project will impact views of certain landscapes, with little clarity on what that means and what it requires.

“List and describe pristine viewscapes (including national parks, provincial parks, culturally significant areas and areas used for recreation and tourism) on which the project will be imposed,” reads the update. “Describe mitigation measures available to minimize impacts from the project on these viewscapes.”

It gives a sense of what’s to come, but insiders say it only serves to raise more questions.

“There’s really no way to submit information on that if you don’t know what a pristine viewscape is,” Dye said, adding there’s no clarity on how and when a project would impact that field of vision.

On Sept. 11, however, the commission did provide more information on how the inquiry will be structured, starting with a first phase — called Module A — that will examine land impacts and then shift to the impact of renewable growth on the grid.

Dye said questions still remain about how the rules will be applied, but called the Sept. 11 bulletin a “positive first step” in clarifying the inquiry process.

“They’ll release more information as they go, including expert reports that they produce, plus more details on the questions, but for now this is a great start to allow us to begin thinking about how we are going to best represent the renewable energy industry,” he said.

A month after the pause announcement, the inquiry process is only now coming to light — which leaves six months to finalize the process, go through it, craft a report for the government and have the government respond.

Missing deadlines and extending the pause would have a greater impact, said the industry source speaking on background.

Rule changes and uncertainty could have an impact on legislation in Alberta, introduced in 2016, that calls for 30 per cent of all electricity produced in the province to be from renewables sources by 2030 — a target the province was well on its way to hitting.

Dye says despite the moratorium, there are enough projects in the pipeline to hit that target six years ahead of schedule — next year.

But there are some caveats, particularly if those projects are impacted by big changes.

“The moratorium itself just raises the concern that the government may take steps that severely reduce the pace of development or increase the cost of projects to the point where that development may stall,” Dye said.

The industry insider says additional challenges might impact that target outside of the moratorium, with two large gas plants coming online next year that will make it harder for renewables to hit the 30-per-cent generation threshold.

As The Narwhal previously reported, however, the 30-per-cent target represents low-hanging fruit for renewable targets anyway. The real challenge will be moving beyond that figure and towards a net-zero grid fed by ever-growing renewable generation.

The surprise moratorium was unveiled one week before the federal government released its long-anticipated draft clean electricity regulations, meant to steer the country towards a net-zero grid by 2035.

The governing United Conservative Party in Alberta has long railed against the plan, calling it unsustainable, too hard on the province and even releasing misinformation on the cost of the plan during the spring election campaign.

It’s one prong in the government’s push against what it sees as federal intrusion on provincial autonomy when it comes to resources, including the carbon levy, clean fuel regulations and environmental assessments.

But it’s also part of a stronger push by the government under Premier Smith to bolster the oil and gas industry.

By September, her government started referring to the net-zero push as “Ottawa’s unaffordable blackout regulations.”

“Ottawa’s plans will drive away future investments in many sectors of our economy,” Smith told a room of oil and gas executives in August. “And Alberta will be at risk for blackouts and brownouts — and that is not an idle concern of mine.”

During that same speech, Smith once again put her support behind developing natural gas in the province for the Alberta grid and to export internationally to displace coal.

A few days later, she tried to blame renewables for an alert from the Alberta Electricity System Operator warning of strain on the grid. But that alert had more to do with natural gas plants going offline due to the heat and a severed connection with B.C., as reported in the National Observer.

The pause is also a stark contrast to the province’s handling of the oil and gas sector, where over 70,000 inactive wells are languishing. The Alberta Energy Regulator estimates there are at least $30-billion worth of liabilities on the land without including the oilsands, but even it acknowledges that estimate is too low.

In an emailed response to questions from The Narwhal, Alberta’s minister of affordability and utilities said the government is committed to a net-zero grid, but sets the target at 2050. For that, the government says it is on track.

“We have an obligation to protect prime agricultural land while ensuring a reliable and affordable electrical grid for all Albertans,” read the emailed statement attributed to the minister.

“We will move quickly following the inquiry to implement changes to ensure Alberta remains the best jurisdiction in Canada to invest in, well into the future.”

Enbridge Gas will face Waterloo Region in a hearing before the Ontario Energy Board to renew an agreement that would allow the company to continue...

Continue reading

When maps showing areas most likely to flood are outdated, it puts people and property...

We’re suing the RCMP for arresting a journalist on assignment for The Narwhal. It’s an...

As glaciers in Western Canada retreat at an alarming rate, guides on the frontlines are...