The site of an infamous B.C. mining disaster could get even bigger. This First Nation is going to court — and ‘won’t back down’

Xatśūll First Nation is challenging B.C.’s approval of Mount Polley mine’s tailings dam raising. Indigenous...

Get the inside scoop on The Narwhal’s environment and climate reporting by signing up for our free newsletter.

Don Taylor is a well-known figure in the world of business and philanthropy in Alberta. His family name adorns university libraries and performing arts centres, not to mention the newly built polar bear enclosure at the Calgary Zoo.

He’s an officer of the Order of Canada and a laureate of the Alberta Business Hall of Fame, largely for his work building a company called Engineered Air into one of North America’s largest manufacturers of heating, ventilation and air conditioning systems. Taylor is also known for his decades-long push to nearly double the size of Canmore through the Three Sisters Mountain Village development, which he co-owns.

What Taylor is not known for is being one of the owners of oil and gas operators that have failed to pay their bills when it comes to required oil and gas cleanup fees. According to the Alberta Energy Regulator, one of two delinquent companies he co-owns also owes over $180,000 in unpaid municipal taxes.

Part of the reason that’s not well known is simple — the information is not easy to come by.

For the past two years, the Alberta Energy Regulator has issued an annual liability management report, highlighting its progress on tackling Alberta’s multi-billion-dollar oil and gas cleanup problem. Part of that reporting includes publishing the names of companies that have failed to make specific payments related to cleaning up old wells — minimum spending on closing old wells, or mandatory levies paid to the Orphan Well Association which cleans up sites with no viable owner.

But that list means little to most Albertans, and it certainly doesn’t shed light on the people behind these companies.

The Narwhal spent weeks collecting and organizing corporate registry documents for the companies named by the regulator and built a detailed database of the voting shareholders, directors and any associated companies.

The end result is a peek into the complex web of ownership in Alberta’s oilpatch, and sheds light on some of the prominent people — including Taylor, former prime minister Stephen Harper and other well-connected businesspeople — behind companies the regulator says haven’t met their obligations.

Some of the ultimate decision-makers and beneficiaries of the companies listed by the regulator have significant power and wealth — wealth that likely exceeds any amount owing for the right to extract the province’s natural resources.

The Narwhal has focused on highlighting some of the more prominent names attached to a small handful of companies. Despite the millions owed, the listed companies still represent only a small portion of the multi-billion-dollar cleanup costs in the province. And while transparency is a crucial first step, some critics say the regulator needs to do more to address the larger cleanup issue.

David Cooper, a professor emeritus in accounting who studied regulatory systems at the University of Alberta, says transparency is critical in regulatory work and Alberta needs to catch up.

“In many jurisdictions, there are many more restrictions on making your company anonymous or making ownership anonymous,” he said. “Alberta is an outlier in regard to the secrecy of corporate behavior and ownership in Canada, let alone the rest of the world.”

Looking at the regulator’s list of delinquent companies, there would be no way to tell that some companies are intricately linked.

Primrose Drilling Ventures and Crimson Oil and Gas are both controlled by Altima Resources, for example, and all three show up on the regulator’s list — Primrose only for 2023.

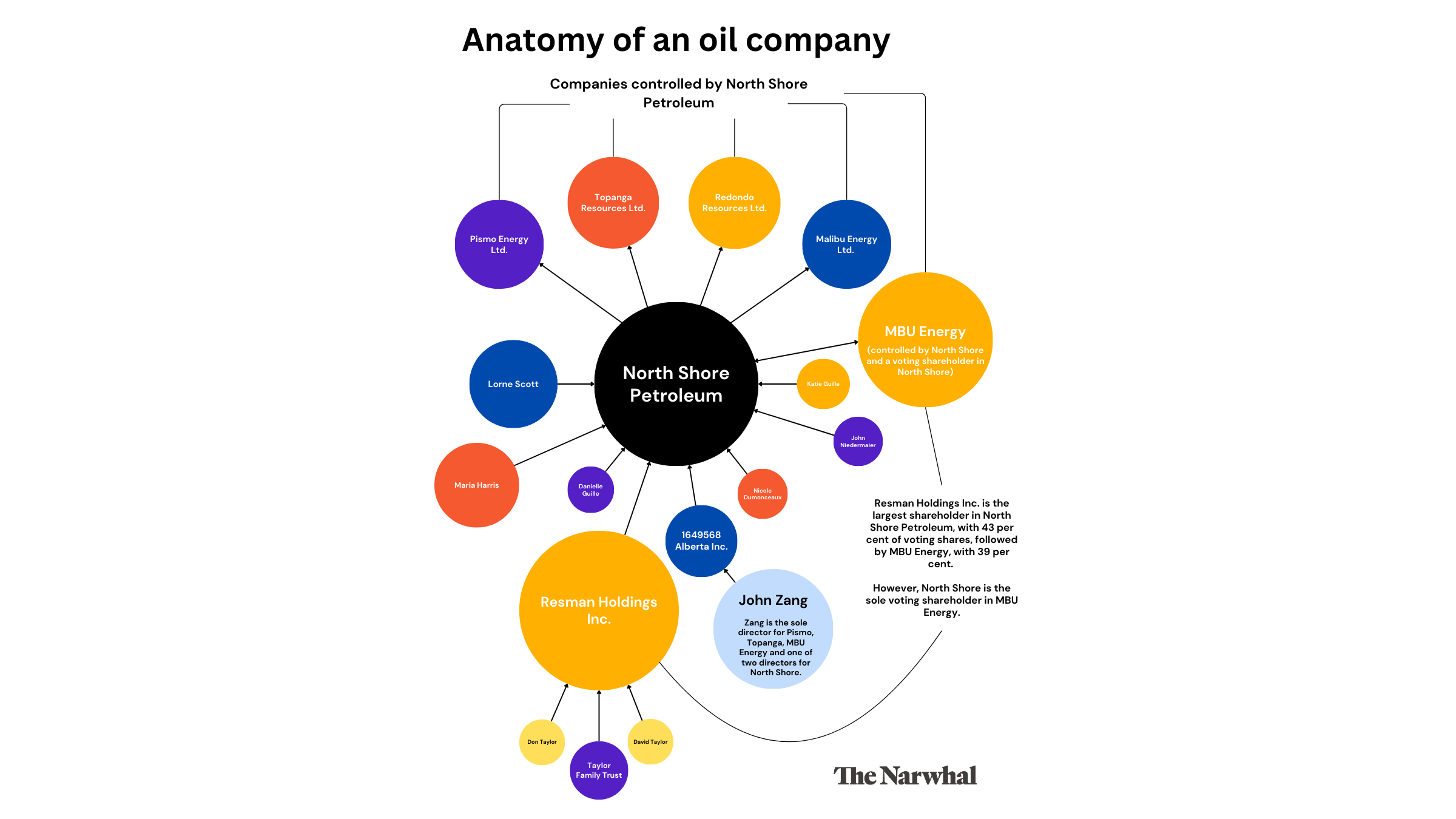

A similar situation revealed itself in the case of Topanga Resources and Pismo Energy, both of which required digging into several layers of ownership documents before determining who owned and benefitted from them.

The sole voting shareholder of both companies is North Shore Petroleum, whose largest single shareholder is Resman Holdings Inc at 43 per cent. That company is controlled by the Taylor family.

Resman Holdings’ sole voting shareholder is the family trust, under the names of Don Taylor and his son, David.

Collectively, Topanga and Pismo have estimated liabilities of $14.3 million and have failed to meet the regulator’s minimum cleanup spending requirements, and to pay the required orphan fund levy, in both 2022 and 2023.

It owes just over $900,000 in overdue liability spending quota payments.

Pismo was put into receivership in December last year, and has a list of orders, sanctions and warnings on the regulator’s compliance dashboard, including failure to report and clean up spills. In a September 2024 order, the regulator said the company owed more than $180,000 in unpaid municipal taxes.

Over half of Pismo’s wells are inactive, according to the regulator — over 80 per cent of which are not compliant with regulations and 22 per cent of which have been inactive for more than 10 years. Inactive wells have not been properly sealed and the ground around them has not been reclaimed. They could theoretically be brought back into production, but can languish idle on the landscape for years.

The company has been ordered to suspend and permanently seal its wells.

Topanga faces a similar list of infractions and orders from the regulator, including one that calls for it to seal its wells, which Topanga attempted to block by arguing it was attempting to sell its assets.

In February, the regulator transferred some of the company’s wells to the Orphan Well Association.

Don Taylor did not respond to multiple requests for comment. John Zang, the director of both companies listed as the contact person in corporate documents did not respond to an interview request or written questions and it’s unclear whether he forwarded a second email to Don Taylor as requested.

A follow-up email was sent to Don Taylor through the lawyer listed in receiver documents for Resman Holdings Inc., but there has been no response. Don Taylor also did not respond to a letter dropped off by hand in the mailbox of his Calgary home.

An email was also sent to David Taylor at the email address listed on the Resman Holdings website, but there was no reply. There was also no reply to a voice message left at the number listed for David Taylor on that same site. Registered mail sent to the home David Taylor did not receive a reply.

Some of the companies listed by the regulator wouldn’t draw much attention for their failure to pay aside from the names attached to them.

Recover Inc., for instance, is a company that takes oilfield waste, cleans it and then recycles the leftovers for other uses. It was listed as delinquent for not paying its share of the Orphan Fund Levy in 2022, but has since paid its bills and was dropped from the list in 2023.

However, documents show Stephen Harper, the former prime minister of Canada, sits on the company’s board and is also a working equity partner in Azimuth Capital, which is the majority voting shareholder in Recover Inc.

Harper did not return a request for an interview or respond to emailed questions. Courtney Burton, a lawyer for Recover Inc. replied to say the company’s non-compliance was “an administrative oversight which, once discovered, was immediately corrected.”

Harper was recently appointed by Alberta Premier Danielle Smith as the chair of the Alberta Investment Management Corporation. The crown corporation oversees approximately $170 billion in public investments, including public pensions.

Burton did not respond when asked if the company could clarify the nature of that oversight or when it was resolved.

Not all of the outstanding fees are as small.

Don Taylor isn’t the only big developer whose name is tied to delinquent companies.

New North Resources Ltd. has failed to pay its mandated minimum on well cleanup in both 2022 and 2023. In light of those infractions, the regulator has concluded the company poses an “unreasonable risk” and says it will prevent New North from acquiring new licences until it is compliant.

The company is largely owned by developers and prominent businesspeople in Alberta, including Jay Westman, the chairman and CEO of Jayman Built, one of Calgary’s largest home builders.

He is a voting shareholder in New North alongside other developers, either listed personally or through companies which they control.

Among them is Harvey Thal, chairman of Royop, and his son Jeremy Thal, its current CEO, who controls a numbered company that is a voting shareholder in New North.

Royop is a major strip mall developer and the numbered company tied to Jeremy Thal — 747384 Alberta Ltd. — is a shareholder in dozens of companies linked to those properties.

Another voting shareholder is Marc Staniloff, the president and CEO of Superior Lodging, a major hotel franchiser that boasts 215 branded hotels in Canada.

Staniloff and Harvey Thal both also sit on New North’s board alongside brothers Terry and Donald Richardson, the founders of Crowfoot Wine and Spirits — a chain with seven locations in Calgary.

New North has 198 licences, according to the regulator, and estimated liabilities of $17.1 million. Of those licences, 71 are for inactive wells, and a further 58 are for marginal wells which have low production.

It has also been cited in the past for failing to conduct a required feasibility study prior to drilling horizontal wells, for using sub-par materials on pipelines and for not undertaking adequate testing. The latter resulted in a suspension of operations for that section of pipeline in 2021.

The company owes just over $540,000 for its outstanding closure spend quota.

In the most recent order from the regulator on March 12, the company is required to submit over $1 million in security to help cover portions of its liabilities. The order includes a seven-page list of regulatory infractions that need to be rectified and says the company has a history of failed field inspections.

There was no reply to multiple emails sent to New North, asking to speak with the individuals highlighted in this story.

Individual emails were also sent to the private and/or company email addresses of Staniloff, Westman, Harvey Thal and Jeremy Thal. There were no replies.

Registered mail was also sent to the home addresses of Terry and Donald Richardson. Tracking shows both letters were delivered to community mailboxes on March 12. There was no reply.

Only one person contacted by The Narwhal agreed to an interview regarding their ownership of a delinquent oil and gas company.

Robyn Lore, who gained some notoriety when he was fined by Alberta’s electoral commissioner for funnelling illegal money into the United Conservative Party leadership campaign of Jeff Callaway in Alberta, is a one-third owner of Richards Oil & Gas through his company Agropyron Enterprises.

That company, which has 27 licences and estimated liabilities of $1.4 million, didn’t pay its minimum cleanup amounts in either 2022 or 2023.

Lore says he and his partners bought the gas wells about 15 years ago from a company that was bankrupt.

“We’ve kept those under production and never made much money at it,” Lore said in an interview with The Narwhal, admitting the company has not paid the minimum cleanup amount.

“A couple of years ago — 2022 I think — the rules changed and there was a required abandonment spend, and that you also have to document that,” Lore said, referring to the industry term (abandoning) for permanently sealing a well. “And we haven’t made those payments.”

The total amount owing for the company is just over $82,000.

Asked why Richards hasn’t paid up, Lore simply says it doesn’t have the money.

Lore said the company is in the process of selling the wells to another company, which he says will have the resources to meet regulatory requirements and levies and notes it is increasingly difficult for small operators to exist in Alberta’s patch.

“These sorts of regulations cause the oil business to only have big companies that have ongoing well-abandonment programs just as a matter of their business course,” he said.

University of Calgary law professor Martin Olszynski, who studies oil and gas liabilities, has a similar concern about large companies, albeit for different reasons.

He argues publishing the list of companies that haven’t paid their orphan levy and/or liability spending quota, appears transparent — but works to obscure the real problem.

Olszynski worries the biggest offenders, in terms of inactive assets, aren’t even on the list, but that’s because they know enough to stay on the right side of what he sees as weak laws. He notes that Canadian Natural Resources has approximately 20,000 inactive wells — almost a quarter of all such wells in Alberta.

“They pay their portion of an entirely inadequate orphan well levy, and they pay their required closure spend, but it makes virtually no difference in their liabilities,” he said. “And it won’t, until they too face financial distress, at which point the system will trigger a cash call, which of course will be too late.”

Canadian Natural Resources did not respond to The Narwhal request for comment.

The Alberta Energy Regulator’s own stats on liability and orphan levy spending highlight the relatively small number of companies that show up on its delinquent list. It notes 91 per cent of licencees were compliant with closure spending quotas in 2023 and the delinquent companies represent less than one per cent of the required industry spending.

In total, the regulator estimates oil and gas liabilities amount to $36 billion, but critics like Olszynski have questioned the veracity of that figure and say it could be significantly higher. That number also excludes the oilsands, where liabilities exceed $50 billion, according to the regulator.

But the companies listed by the regulator for not paying their dues also represent hundreds of wells, pipelines and facilities spread across the province. It adds up to a patchwork of infrastructure that has a direct impact on landowners and the general public.

The regulator has the ability to sanction individuals for the actions of the companies they own or direct, but Cooper from the University of Alberta says that never happens.

Those associated with problem companies could be prevented from acquiring new licences, even under a different corporate name, and companies associated with a problem company could face similar repercussions.

The regulator says in cases of failure to pay levies or meet mandatory cleanup costs, regulatory action is taken against the licencee and not individuals, but there can be consequences for individuals in some circumstances and corporate ownership and structure can factor into its determination of financial risk when evaluating companies.

Coral Hulse, a spokesperson for the regulator, said the regulator can use its discretion on whether or not to name individuals associated with a company for regulatory infractions and that it has done so. Instead of providing examples, it directed The Narwhal to its compliance dashboard, but there is no way to search that public directory for that specific sanction.

When asked for guidance, Hulse said the dashboard “requires a manual search of individual names.”

Despite the long list of regulatory infractions, no individual’s names are associated with New North in the latest order from the regulator.

Hulse said the regulator will use its discretion about whether to consider individuals associated with a company. Those considerations could include connections to other companies or regulatory infractions.

In an earlier response to questions, Renato Gandia, another spokesperson for the regulator, said it collects financial and reserve information from licencees, but those records are kept confidential for five years in the case of financials and 15 years in the case of reserves.

“The information submitted by a licencee to the [Alberta Energy Regulator] will remain confidential; however, some of the findings or results generated from [Alberta Energy Regulator] assessments using the financial and reserve information will be made available through liability management reporting and compliance and enforcement responses,” he wrote.

Even with the level of digging undertaken by The Narwhal, we still haven’t been able to get to the bottom of each and every company, shell company, holding company and partnership.

If you have tips on who’s behind oil and gas companies in Canada that aren’t paying their bills, please contact Prairies reporter Drew Anderson over email at drew@thenarwhal.ca or securely over Signal at @Danderson.78.

Get the inside scoop on The Narwhal’s environment and climate reporting by signing up for our free newsletter. When I visited my reserve, Moose Factory,...

Continue reading

Xatśūll First Nation is challenging B.C.’s approval of Mount Polley mine’s tailings dam raising. Indigenous...

As the top candidates for Canada’s next prime minister promise swift, major expansions of mining...

Financial regulators hit pause this week on a years-long effort to force corporations to be...