The Right Honourable Mary Simon aims to be an Arctic fox

Canada’s first-ever Indigenous governor general doesn’t play favourites among our majestic natural wonders, but she...

Mark Little wrapped up oilsands giant Suncor Energy’s February 2022 earnings call by reassuring investors that shareholders would have more cash in their pockets than the year before.

“We think we have a great company,” Little, Suncor’s CEO, said on the Feb. 3 call, which lasted about 40 minutes. “I’m strengthening the balance sheet [and] making investments for our future to support the continued growth and cash flow and shareholder returns for many years to come.”

Missing in the conversation that day, however, were any specific details about how the company’s growth strategy could be thrown off by the climate crisis, which is causing mass death of species and stranding millions of people without food or water security, and will be made worse by fossil fuel production plans around the world — plans which Suncor, a major player in Alberta’s oilsands, expects to contribute up to 790,000 barrels of oil equivalent every day.

Little did discuss how his company was focused on driving down carbon pollution from its operations, and Suncor has published information about climate-related risks and opportunities to its business.

But an investigation by The Narwhal has revealed that Suncor — along with other fossil fuel firms and dozens of companies and organizations from other sectors — is also pushing back against game-changing financial disclosure proposals that, if implemented in Canada, would set clear standards and force companies to be more transparent and specific about how climate change could disrupt their operations and finances. The Narwhal reviewed the positions of more than 100 companies and organizations and found the majority were opposed to such standards.

Canadian regulators released their proposal last fall, recommending that publicly listed companies should publish climate disclosure reports with detailed metrics and targets, along with information about how companies plan to deal with the climate crisis. The proposal was largely based on recommendations first made in 2017 by an international committee chaired by billionaire Michael Bloomberg that calls itself the Task Force on Climate-related Financial Disclosures.

New rules would mean public companies would need to regularly publish additional climate information to participate in capital markets, like the Toronto Stock Exchange, Canada’s largest stock exchange.

As regulators hammer out the fine print of new rules, an avalanche of Canadian companies and special interest groups — representing a range of sectors including the oilpatch, mining, manufacturing, utilities, banking, accounting, investments and insurance — have pushed for a delay to major reforms.

The pushback is laid out in written submissions filed over the past several months to the provincial and territorial regulators of Canada’s capital markets, where companies like Suncor trade. Regulators of these markets work together to ensure no misconduct takes place, and coordinate on rules nationwide under the banner of the Canadian Securities Administrators.

Two-thirds of the companies and organizations that wrote to regulators between October 2021 and February 2022 said they were opposed to key measures that would force them to reveal more in their financial disclosure documents about how they plan to deal with climate-related changes to their business, according to an analysis by The Narwhal.

Submissions were gathered before the invasion of Ukraine that has killed and injured thousands of people, upended global markets and led to a scramble to pull out investments and suspend or shut down businesses with ties to Russia, including Russian state-owned oil giant Rosneft.

The same scramble is lying in wait for Canadian companies who cling to polluting assets for too long. The Bank of Canada and the Office of the Superintendent of Financial Institutions — a federal regulator — also flagged this threat in January when they released a report showing that if Canada’s transition to a low-carbon economy is too abrupt or too late in the game, that could destabilize the economy, send assets crashing in value and threaten the jobs and retirement savings of Canadians.

As a result of the looming threat of climate change, Canadian regulators are trying to intervene in markets before they suffer the fallout of climate-related shocks. That risk has been behind the push to make companies much more transparent about the pollution their products are generating and how their businesses could be disrupted by the climate crisis.

Without that transparency, regulators warn, Canada’s economy will continue ballooning into a “climate bubble” that will eventually explode in a disorderly, sudden way — not dissimilar to how Russian divestment has unfolded.

Of all the voices pushing for regulators to delay or abandon reforms to climate transparency rules, oil and gas companies have been particularly vocal.

In written submissions reviewed by The Narwhal, company executives frequently cite the “burden” of the workload that would stem from having to comply with climate transparency rules.

This comes at a time when oil and gas companies are announcing billions of dollars in profits in recent earnings reports, with the sector sitting on about $75 billion in cash. Corporate profits in Alberta soared by 147 per cent in 2021, and that was before crude oil prices skyrocketed due to supply disruptions caused by Russia’s assault on Ukraine.

In February, Suncor announced $1.53 billion in profits, but a month earlier Suncor wrote a letter to provincial regulators arguing it wouldn’t be “useful” to publicly reveal one of the proposed transparency exercises, which would have the company publish what’s known as climate scenario planning.

The premise of climate scenario planning is simple — a company must explain how it would fare in a world committed to substantially less carbon pollution. A company might, for example, lay out a scenario in which the world meets the Paris Agreement goal of holding global average temperature increases to below two degrees Celsius above pre-industrial levels.

Scenario planning can illustrate both the physical impacts of climate change and the economic transition ushered in by climate policies. For example, one scenario, dubbed the “hot house world” scenario, contemplates how a company’s business will fare if climate policies fail to slow significant global warming and “critical temperature thresholds are exceeded leading to severe physical risks and irreversible impacts like sea-level rise.”

Not one of the oil and gas companies that made submissions to regulators wrote clearly in favour of immediate mandated disclosure of climate scenarios. Their submissions also indicate that none of the companies actually know the full extent of how the climate crisis will damage their businesses.

For example, while Suncor says it does some internal analysis of future scenarios and describes this as “beneficial for investors as it relates to our view of risk,” the company argues it would not “be useful at this stage” to share this planning with members of the public “because it is overly complex” and would require making a number of assumptions.

Suncor and others who are pushing back against immediately implementing tougher rules also argue that because international standards are still being finalized, any information they do reveal runs the risk of being inconsistent, especially across different sectors, leading to the potential for misleading conclusions to be drawn by investors.

Tourmaline Oil, which bills itself as Canada’s largest natural gas producer, has similar concerns. Tourmaline reported $2 billion in net profits in 2021, but the company complained to regulators of the “cost” and “burden” to undertake scenario planning, as well as of another transparency measure that would require the company to calculate and publish the carbon pollution generated when its natural gas is burned by consumers. (Suncor also does not support this measure, citing a lack of guidelines on how emissions would be calculated or reported.)

Baytex Energy, which is active in conventional drilling and fracking in both Alberta and Texas, also argued the mandatory preparation and disclosure of the emissions from burning its products “would be particularly burdensome.”

The company wrote in its submission to regulators that climate scenario planning “should not be required” to be publicly revealed because the information used to prepare the exercise is “inconsistent.” Like Suncor, Baytex too said the results would not be “useful.”

Pembina Pipeline, which operates over 18,000 kilometres of pipelines carrying crude oil, natural gas and other petroleum products in Canada and the United States, told regulators in a letter that while the company recognized the value of climate scenario planning and used the tool internally, it also believed it should not be required to reveal it to the public.

There were a number of assumptions required to complete this exercise, the company wrote, and so it would provide “little benefit to investors, especially when weighed against the significant costs that would be incurred by [companies] to prepare such information.”

These oil companies have been backed up by industry lobby groups. The Canadian Gas Association told regulators scenario planning requirements should be “excluded in all cases” because it could lead to “confusing modelling and reporting for investors and market participants.” The Canadian Association of Petroleum Producers said in its submission that it was “premature” to mandate scenario planning as it was “difficult to compare and contrast” scenarios from different companies.

In response to The Narwhal’s requests for comment, the Canadian Association of Petroleum Producers said it had nothing further to add on the topic. Tourmaline Oil, Baytex Energy, Pembina Pipeline and the Canadian Gas Association did not respond to requests for comment.

Though oil and gas companies repeatedly cite the “burden” of new scenario planning regulations, whether the effort required is overly burdensome is a matter of debate.

Bloomberg’s task force produced a “guidance” document in 2020 stating that “getting started using scenario analysis is not difficult.” A typical process, they wrote, “often takes only a handful of full-time staff and less than a year (often three to nine months) depending on the size of the company and the scope of the decisions under consideration.”

The British Columbia Investment Management Corporation, a large institutional investor in Canada with $199 billion in assets under management, also argued in its letter to regulators that “scenario analysis does not need to be an exhaustive process,” that requires companies to start from scratch. The corporation wants to see a requirement for scenario planning transparency “for at least some companies.”

In a Feb. 14 response to The Narwhal’s questions, Suncor media and social advisor Leithan Slade pointed out that the task force itself has acknowledged its guidance document on scenario planning is not meant to be a “checklist of everything a company should do” to meet transparency standards.

Suncor has “an extensive history of reporting in our annual report on sustainability and our climate report,” Slade wrote. “Suncor is committed to credible, transparent and industry-leading sustainability reporting.”

Slade also said Suncor has prepared a scenario in line with its support for the task force and Paris Agreement, published in its climate report, which looked at “a plausible pathway to keep global temperatures from rising [two degrees Celsius] or less by 2100.”

That scenario analysis is one page long and mostly discusses the impact on global energy markets. Its section on disruptions to the company itself is 39 words long and related to growing the firm’s electricity and hydrogen business, “transforming” the carbon footprint from its oil production and commercializing unspecified climate “solutions.”

It is difficult, however, to gauge what strategy Suncor is deploying to address the risks it recognized as part of the exercise, or what detailed changes Suncor may be considering to its business model — both central elements to climate scenario planning, according to the task force’s guidance.

Michael Bloomberg and the task force he chairs are not alone in calling for increased climate transparency in financial disclosures — and time is of the essence, according to proponents.

Regulators must adopt the task force’s key measures if Canada has any hope of sticking with its plans to limit pollution and slow climate change, according to Principles for Responsible Investment, a United Nations-supported initiative that counts over 4,300 pension funds, insurers, investment managers and other financial industry entities around the world, including more than 200 headquartered in Canada. The initiative collectively represents hundreds of trillions of dollars in assets.

“Nothing less than an ambitious, significant and concerted whole-of-government approach to regulatory action will be enough to meet the challenge of Canada’s 2030 and 2050 targets,” the initiative wrote in a letter to regulators. “This not only applies to decarbonizing Canada’s energy system, but also leveraging the financial sector to enable and drive deep decarbonization of the economy.”

Despite this, 84 of the 130 submissions made in response to the regulators’ proposal take issue with at least one of several key climate transparency measures, The Narwhal has found.

Almost half of the organizations that responded to regulators were against requiring companies to start disclosing their scenario planning when the new rules kick in, while under a third were in favour. The remainder of the respondents either did not discuss scenario planning or The Narwhal could not determine their position.

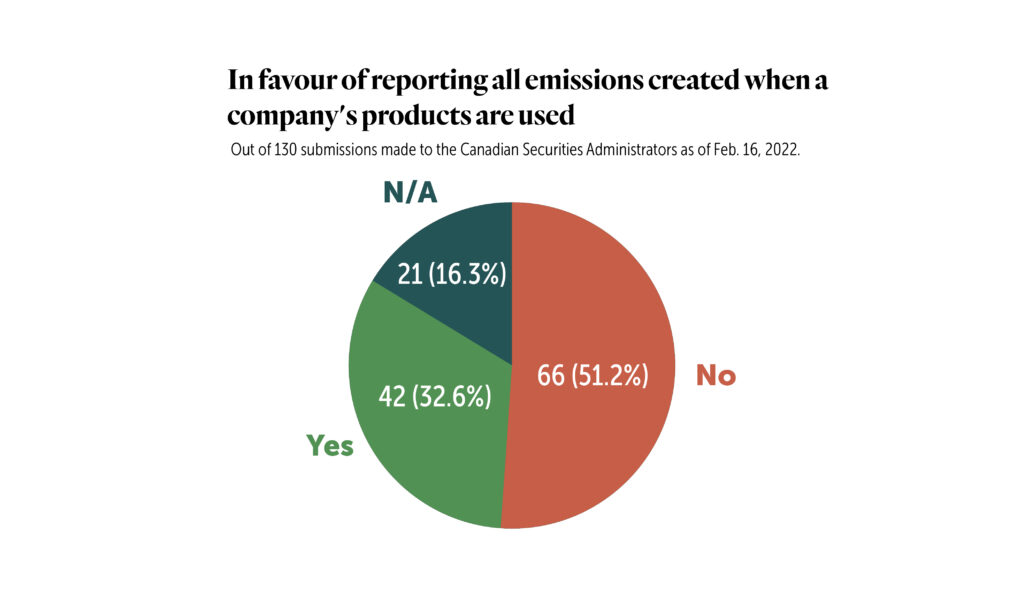

Over half of the respondents said they were against rules that would make them start revealing emissions from their products, while a third were in favour and another sixth could not be determined.

Meanwhile, the push for more transparency could soon affect companies trading on American stock exchanges.

The U.S. Securities and Exchange Commission (SEC) unveiled a proposal on March 21 that would establish climate-related disclosure requirements, such as details on how climate-related risks have affected a company’s “strategy, business model and outlook.”

The U.S. proposal would ask companies to disclose details of any existing scenario planning already underway. This could include disclosing any projected financial impacts.

It would also ask a company to publish details of the emissions from the burning or use of its products if it has set a climate target that includes these emissions.

“Today, investors increasingly want to understand the climate risks of the companies whose stock they own or might buy,” commission chair Gary Gensler explained in a March 10 video on Twitter, providing an overview of the proposal.

“A lot of companies are already providing such information about climate risk, but investors representing literally tens of trillions of dollars are looking for more consistent and comparable information so they can make informed decisions about where to put their money — and that money is often the money they are investing for us.”

The European Commission and the United Kingdom are also pursuing similar regulatory changes.

When the British government carried out its own public consultations on potential climate-related financial disclosures in spring 2021, they also asked companies and organizations about what they thought of rules that would require firms to publish climate scenario planning.

The British government said it received “mixed feedback” to this question. Out of 107 responses, respondents were split almost evenly on whether companies should be forced to reveal this information, with slightly more in favour of disclosures.

Though the British government was initially reluctant to mandate climate scenario planning, the survey results and “compelling feedback” prompted a “reconsideration” of its approach. Scenario planning requirements will be part of new financial transparency rules that will come into force in April.

Climate scenario planning is also part of a new suite of financial disclosure measures developed in 2021 that accounting firm Ernst & Young believes will form the basis of a “global baseline” for transparency standards this decade, according to its Feb. 15 letter to Canadian regulators.

The new suite of measures were developed by a coalition of experts which included Bloomberg’s task force, and were published in November 2021 — a month after Canadian regulators’ proposal was published.

Unlike the Canadian proposal, these measures do recommend that companies publish a “diverse range” of climate-related scenarios — asking firms to reveal step-by-step details such as the assumptions the company made as it went about preparing its findings.

In its letter, Ernst & Young urged Canadian regulators to align their rules with the international standards being developed by the new International Sustainability Standards Board — including rules related to climate scenario planning.

“We believe scenario analysis should be required to be disclosed as it would enhance the competitiveness of Canadian companies internationally, given certain jurisdictions have already mandated disclosure,” the firm wrote.

The Canadian regulatory proposal itself, as written in October 2021, excludes certain groups like investment funds from the new transparency requirements.

The proposal would also not force companies to disclose their scenario planning, publish the emissions from the products they produce, or require their emissions to be independently audited.

In the proposal, regulators wrote they deviated from international recommendations because they were “sensitive to concerns related to the regulatory burden and additional cost” that companies would bear if forced to be more transparent.

A number of fossil fuel companies agreed that regulations should not require them to be transparent about how climate change would disrupt their businesses

“This approach is appropriate,” wrote Whitecap Resources, a Calgary-based oil and gas company focused in Western Canada, in a letter to regulators, referring to their decision not to make climate scenario disclosure mandatory.

TC Energy made similar comments, writing in their own letter, “while scenario analysis is useful internal analysis, we support the exclusion of scenario analysis as required disclosure in the proposed instrument.”

TC Energy also said they were against requirements to disclose emissions from the burning of its oil and gas products.

A representative from TC Energy’s media relations declined to answer questions. Whitecap Resources did not respond to The Narwhal’s request for comment.

The regulators’ approach surprised Engineers and Geoscientists BC, the professions’ regulatory body, which wrote in its own submission that it was “not clear” why regulators had taken a different path than the international Bloomberg-led task force.

“The future we are heading into is not well represented by past data or trends, and in this absence of experiential evidence, scenario planning is known to be an effective risk management tool,” the group added.

The comment period over the new disclosure rules ended in February, and regulators now plan to consider all the comments over the next several months. The proposal suggests a one-year and three-year phase-in period.

Tonya Fleming, senior counsel with the Alberta Securities Commission, has been working with regulators across the country on the proposed new disclosure rules, and has stressed that the proposal is still being worked out.

During a Jan. 20 online information session the commission posted on its YouTube channel, she said it was “very likely” the final version of the rules “will look a bit different than what we talk about today.”

Fleming said the team has been “meeting with Alberta companies to talk about what we’re thinking in terms of the proposed rules,” and listening to their “feedback.”

She said large Alberta companies are “absolutely leading the way” when it comes to climate-related disclosures “but some of our smaller [companies] just haven’t started down this path yet.” They may have “very real resource constraints” preventing them from having the ability to produce the material, she said.

“We want to respond to the investor needs and align with the international developments, but we are also cognizant of regulatory burden and the additional cost that our companies will bear when they respond to these new climate disclosure rules,” Fleming said. “We listen, we hear from industry and from investors as to what they’re looking for.”

“We consult with and listen to both investors and issuers when considering new rules, which is the approach we took on the proposed climate-related rules,” said Theresa Schroder, senior advisor for communications at Alberta Securities Commission, when asked for comment on Fleming’s statements.

The Narwhal asked the Canadian Securities Administrators why the proposal deviated from the Bloomberg task force’s recommendations, and which industry associations expressed concerns to them about a “regulatory burden.”

Pascale Bijoux, senior advisor for communications and stakeholder relations, said in an email the proposed disclosures are “the result of engagement and discussion with advisory committees, [Canadian Securities Administrators] members and a wide range of stakeholders,” noting the organization also takes approaches from around the world into account.

Climate scenario planning is a crucial exercise meant to test the resilience of a business strategy, according to the Canadian Institute of Actuaries, the governing body for the profession that measures risk and uncertainty. Without it, there’s “no incentive” for companies to start down a path of increased climate transparency, the group argued in a letter submitted to Canadian regulators.

The Canadian Climate Law Initiative, a collaboration between the University of British Columbia and York University, agreed, saying in their submissions it would be difficult for companies to strategically plan without using climate scenario analysis. The group has released a legal opinion concluding “pension fund trustees have obligations to consider climate change as part of their fiduciary duty.”

The Bank of Canada and the Office of the Superintendent of Financial Institutions have explained in their own climate scenario planning why the absence of tougher rules could lead to a disastrous market failure and massive job losses.

“Meaningful disclosures matter,” Ben Gully, assistant superintendent for regulation at the Office of the Superintendent of Financial Institutions, said during a media briefing on Jan. 14. “Improving disclosures helps financial system stakeholders respond to clear, comparable and consistent information about climate-related risks and opportunities.”

Gully made the comments as the Office of the Superintendent of Financial Institutions — which regulates banks, trust companies, loan companies, fraternal benefit societies and insurance companies — and the Bank of Canada released a report confirming concerns among some analysts who believe Canada’s climate data from businesses is either incomplete or mediocre.

A joint review by regulators in six provinces in 2021, for example, found that over four in 10 companies studied had produced “boilerplate, vague or incomplete” language on climate risks, while a quarter avoided examining the financial impact of climate change entirely.

Canadian pension managers view the current state of climate-related disclosures as “sorely inadequate,” Sara Alvarado, executive director of the Institute for Sustainable Finance at Queen’s University, chair Sean Cleary and research director Ryan Riordan, wrote in a letter to regulators. They pointed to a 2020 statement by Canada’s eight largest pension funds calling for better financial transparency over environmental factors.

Beyond the pressing need for corporations to become more transparent about their actions and their products so Canadians can see the planet-warming potential of their businesses, the Canadian Institute of Actuaries has also pointed out how this transparency is necessary to connect the dots between the drivers of climate change and the “volatility” climate change is causing in insurance claims.

Insurance claims from climate-related disasters have been substantial. The Insurance Bureau of Canada reported $2.1 billion in insured damage across the country in 2021 connected to severe weather — the sixth-highest tally since 1983. It represents what the insurance bureau dubs the “financial costs of a changing climate.” Worldwide, natural disasters caused overall losses of US$280 billion in 2021, according to one estimate.

In Canada, last year’s wildfires, droughts, floods and heat domes hammered home the reality of climate change for many Canadians.

Federal scientists warn Canada is warming at more than twice the global rate, and the risks of flooding, wildfires, heat waves, rising sea levels and other physical dangers will only increase in the coming years, affecting Canadians’ health and wellbeing in addition to influencing practically every economic sector.

But the vacuum of information from Canadian businesses on how they will weather this coming storm has resulted in a chorus of banks, financial experts, pension funds and regulators themselves warning the economy is vulnerable to a ‘“climate bubble” that, when it bursts, could be financially devastating for families and communities.

None of that conversation, however, was present on Feb. 3 during Suncor’s earnings call, where executives discussed how diesel demand was “back to normal,” and how the company’s oilsands assets “contributed record annual funds” in 2021.

“Suncor is well positioned in 2022 to deliver higher production,” Little said, adding he anticipated the company’s plans would “accelerate shareholder returns.”

— With files from Fatima Syed

Get the inside scoop on The Narwhal’s environment and climate reporting by signing up for our free newsletter. A $335 million funding commitment to fund...

Continue reading

Canada’s first-ever Indigenous governor general doesn’t play favourites among our majestic natural wonders, but she...

In Alberta, a massive open-pit coal mine near Jasper National Park is hoping to expand...

A trade war could help remake B.C.’s food system, but will family farmers be left...