The site of an infamous B.C. mining disaster could get even bigger. This First Nation is going to court — and ‘won’t back down’

Xatśūll First Nation is challenging B.C.’s approval of Mount Polley mine’s tailings dam raising. Indigenous...

This investigation is a collaboration between The Narwhal and Future of Good.

Get the inside scoop on The Narwhal’s environment and climate reporting by signing up for our free newsletter.

For nearly two decades, Canada’s mining exploration companies have had an unlikely ally in raising capital: Canadian charities.

The link results from a tax strategy known as charity flow-through. It provides an incentive for wealthy donors to donate shares to a charity, instead of cash.

The complex approach, promoted by several firms since the mid-aughts, involves wealthy Canadians purchasing shares of a mining exploration company only to gift some of them to a charity the same day.

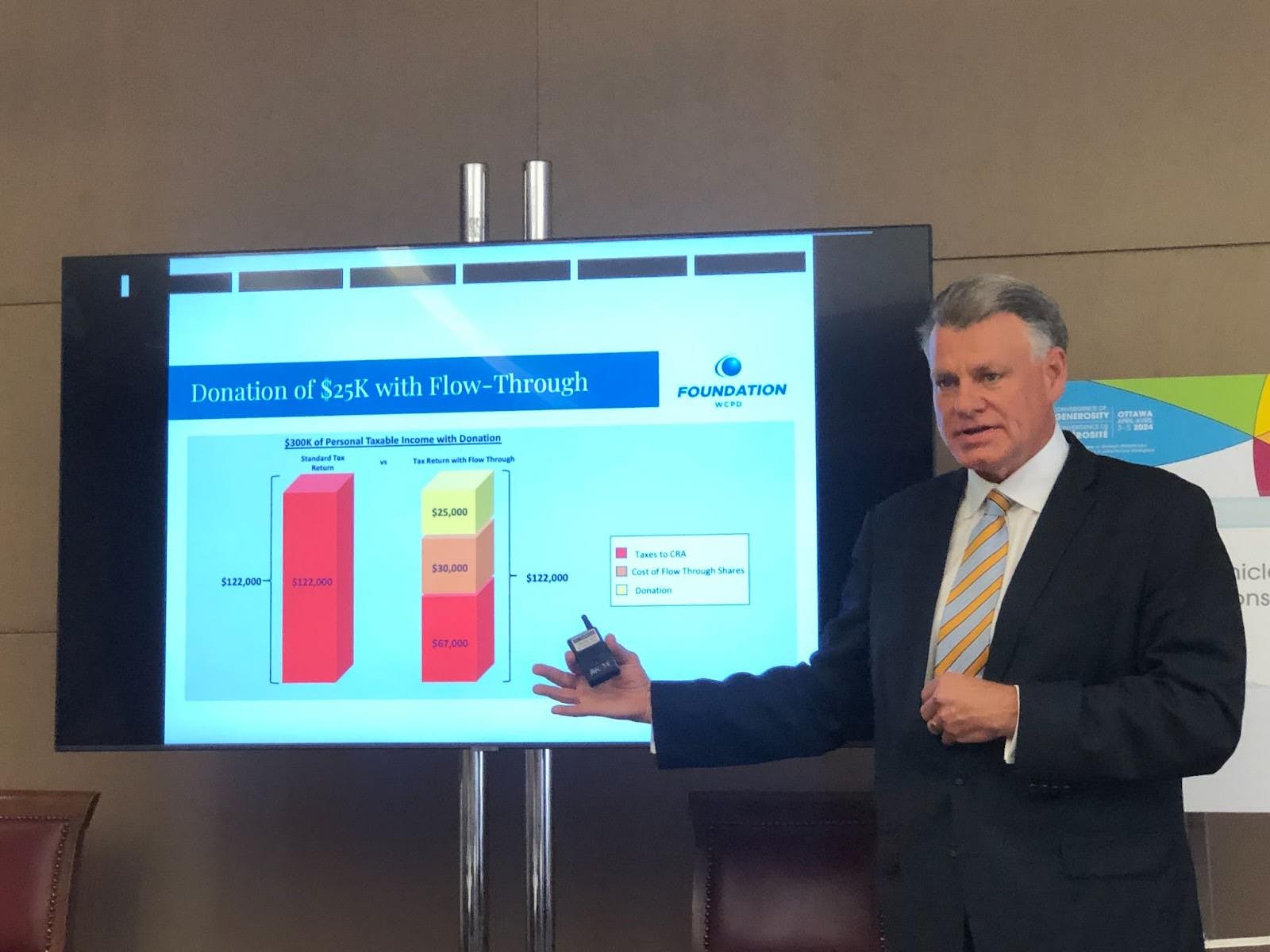

In a best-case scenario, this strategy could allow a Canadian to make a donation worth $100,000 using shares and winding up with a tax break of $99,000, according to Peter Nicholson Jr., founder and president of Wealth Creation Preservation & Donation (WCPD), a charity flow-through provider.

The savings are possible under Canadian tax laws, which allow donors of shares to benefit from mining investment tax credits and deductions, as well as charitable donation tax credits.

“It’s crazy. … It’s practically free,” said John Bromley, CEO of the Vancouver-based Charitable Impact Foundation, which has accepted flow-through share donations.

In contrast, a donor who made a $100,000 cash donation could expect to get a tax break of about $50,000 or less, depending on their province or territory of residence.

While most donors don’t use charity flow-through donations, charitable foundations told Future of Good and The Narwhal that a growing number of wealthy Canadians do.

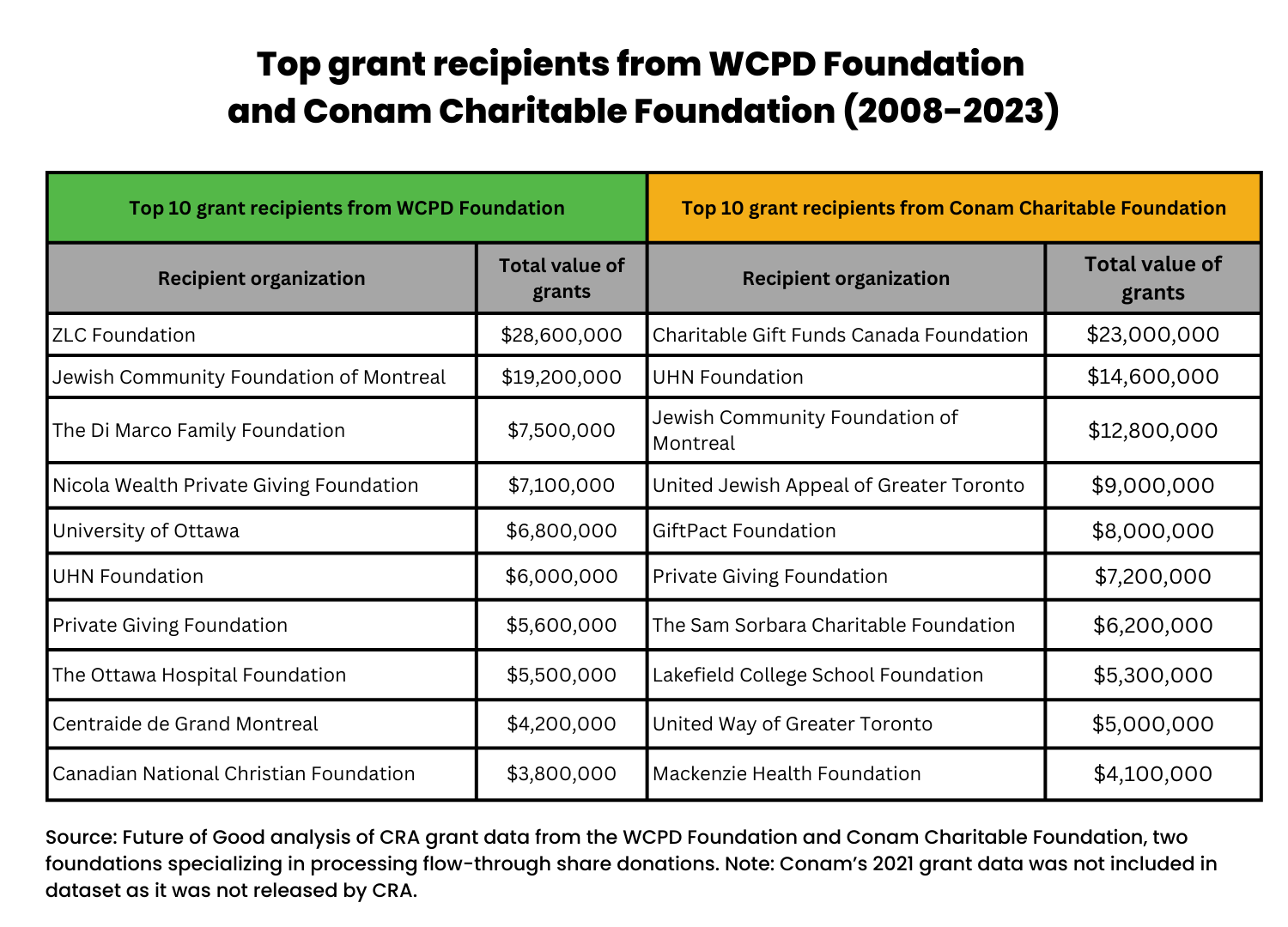

These anecdotal observations are backed up by Canada Revenue Agency data obtained by Future of Good/The Narwhal which shows growth in the volume of donations made to two foundations in Canada that specialize in processing flow-through share donations — the Wealth Creation Preservation & Donation Foundation and Conam Charitable Foundation.

Patricia Saputo, a member of the third generation of the billionaire Montreal cheese empire, used the charity flow-through method to make a $5-million gift to the University of Ottawa.

“Using charity flow-through shares has allowed me to give more than I would [have] otherwise been able to give,” she said in a testimonial for Wealth Creation Preservation & Donation.

The Sorbara family, whose real estate companies have been valued at more than $1 billion, have also used flow-through donations to support hospitals, universities and other charities.

“We help ourselves by creating an opportunity to make charitable donations at a lower cost,” Edward Sorbara, president of the Sam Sobara Charitable Foundation, said by email.

Because of the tax savings for the donor, charity flow-through providers said donors are commonly willing to boost the amount they give to charity, sometimes doubling their gift.

Nationwide, hundreds of charities have received grants from foundations that specialize in processing flow-through share donations, passively benefitting from such transactions.

However, some of Canada’s most sophisticated charities, including the SickKids Foundation in Toronto, have introduced their benefactors to the sophisticated gifting practice, netting millions.

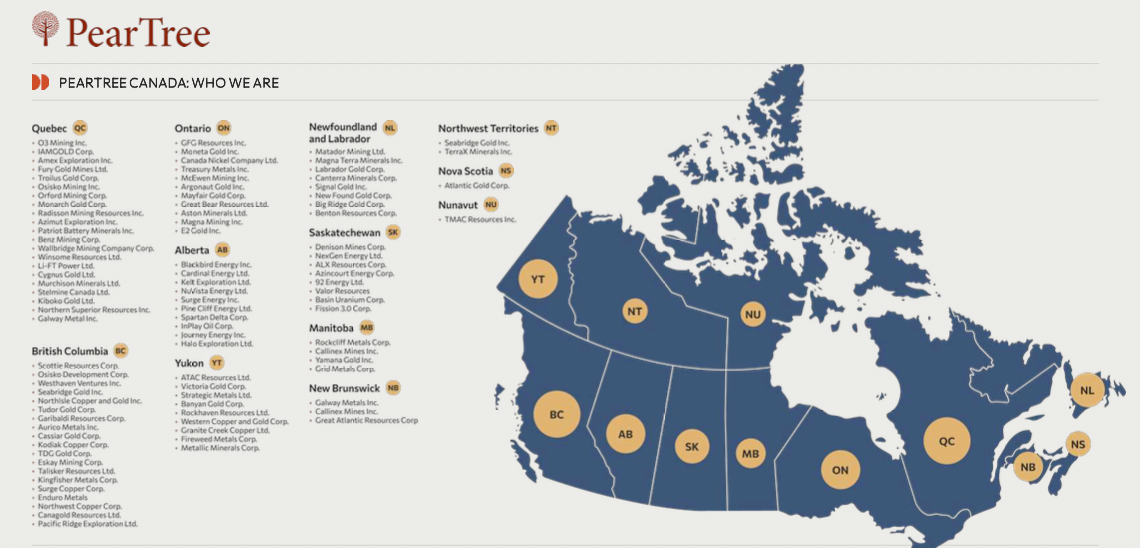

Executives of three of the top charity flow-through firms — PearTree Canada, Oberon Capital and Wealth Creation Preservation & Donation — say their clients have used the strategy to donate about $1.8 billion to Canadian charities collectively.

“We commoditize donations,” Ron Bernbaum, PearTree Canada’s founder and CEO, said.

“If you’re in the market for something and it’s cheaper, you do more — you give more, like any other commodity.”

This philanthropic success has also been a boon for Canadian mining exploration companies.

Bernbaum said his firm’s charity flow-through transactions alone have supported Canadian mining exploration companies nationwide to raise more than $3 billion.

“It’s now the preferred method of raising exploration risk capital,” David LeClaire, founder and president of Oberon Capital, said.

Troy Boisjoli, CEO of uranium exploration company ATHA Energy, said his firm has used charity flow-through because the strategy allows the company to raise the most money while retaining the most shares compared to other fundraising approaches.

“There are not many things that are win-win-win, right? But the charity flow-through structure is one of those,” he said.

However, while charity flow-through providers and some charities echoed this belief, others disagreed.

Merle Davis Matthews, an organizer with the Mining Injustice Solidarity Network and PhD candidate researching mining, said charities should avoid accepting or promoting flow-through share donations until Canada’s laws are rewritten to give Indigenous people more control over their treaty or traditional territories.

Typically, mining exploration companies are not required to secure the consent of Indigenous people on whose treaty or traditional territory they want to explore before beginning work.

In B.C., the Yukon and Quebec, First Nations have successfully sued provincial and territorial governments, arguing aspects of this so-called “free-entry” system violate their constitutional rights.

Two similar lawsuits are ongoing in Ontario.

In the absence of new laws, accepting flow-through shares “just doesn’t feel aligned with the values I’m assuming some of these charities have,” Davis Matthews said.

Others, however, believe charities should continue accepting flow-through share donations but be more judicious about the mining exploration companies they help and ensure Indigenous communities benefit from the exploration work.

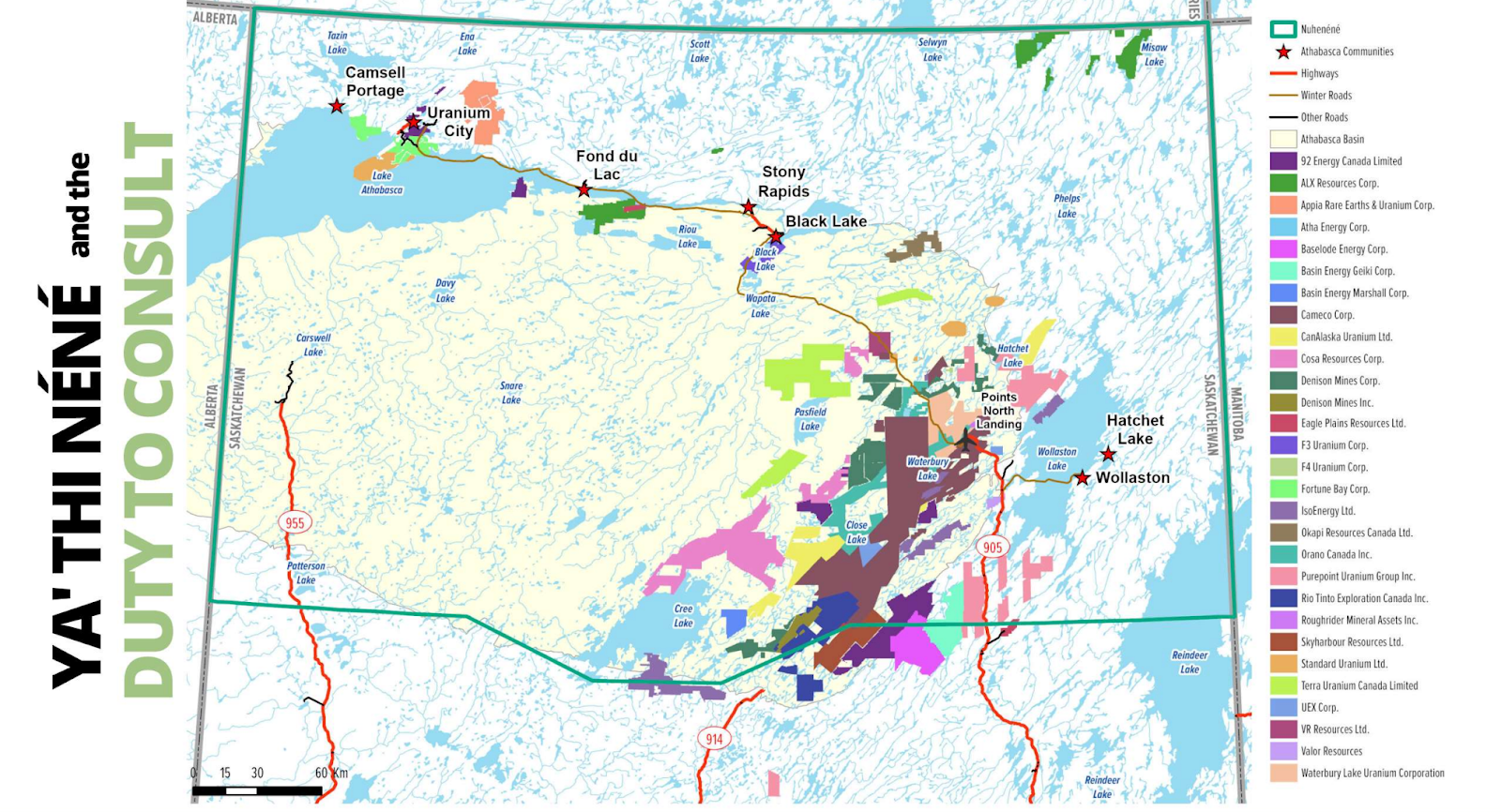

In the past five years, companies exploring northern Saskatchewan’s uranium-rich Athabasca Basin have collectively raised more than $115 million via charity flow-through financing, according to a Future of Good/The Narwhal analysis.

Garrett Schmidt, executive director of local non-profit Ya’ thi Néné Lands and Resources (YNLR), said the charitable sector’s participation in such financing is a “double-edged sword.”

While five companies that have raised money via charity flow-through have signed exploration agreements with Schmidt’s organization, ensuring locals benefit from the activity, seven others that have raised funds via charity flow-through have not.

When charities help finance mining exploration companies that do not have locals’ consent, they are doing residents and the region’s Denesułiné First Nations a disservice, Schmidt said.

While charity flow-through donations are used to finance mining exploration nationwide, there is little public data available about the nationwide totals since there is no requirement that companies or charities publicly disclose this information.

Future of Good/The Narwhal focused on the Athabasca Basin for this story to illustrate the impact of charity flow-through transactions on one region.

Future of Good/The Narwhal contacted all of the charities named in this article for comment.

The SickKids Foundation, Charitable Impact Foundation and many others said that their participation in flow-through share donations is within the guidelines of charitable sector law and said such gifts comprise a small share of total revenue.

Former prime minister Stephen Harper’s government catalyzed the unique relationship between charities and Canadian mining exploration companies in 2006.

At the time, the government sought to facilitate charities’ fundraising by eliminating the requirement that donors pay capital gains on gifts of stocks, bonds and other publicly traded securities.

Typically, when a donor sells a stock that has appreciated, they must pay tax on 50 per cent of the gain.

This policy change meant no such tax was applied when appreciated securities were gifted, enabling donors to give more.

Fundraisers, who had lobbied hard for the change, began encouraging donors to give appreciated securities. In parallel, several Canadian tax planners seized the policy shift as a chance to help the country’s wealthiest people donate more for less.

Their approach leveraged the flow-through share program, created by the federal government decades earlier, to help Canadian resource exploration companies raise capital.

Mining exploration is a notoriously risky financial investment. Many sites are explored, but few turn into mines.

To incentivize Canadians to invest, the government allowed investors to claim a tax deduction for the total cost of shares purchased in a mining exploration company.

When the 2006 capital gains policy was announced, a small group of financial service professionals began combining these two tax policies to support clients to dramatically reduce the cost of their philanthropy.

The combination was sometimes so good that benefactors could use charity flow-through to receive back more in tax credits than the cost of their gift, according to Malcolm Burrows, head of philanthropic advisory services for Scotia Wealth Management.

Despite the attractiveness of the tax incentives, however, PearTree Canada’s Bernbaum said the charity flow-through pitch to donors wasn’t always easy.

Few people had ever heard of the complex maneuver, leaving many to believe it was “too good to be true,” Oberon Capital’s LeClaire said.

In making the case, however, emerging flow-through share providers had documents from Canada Revenue Agency that helped put donors at ease.

In the years following the 2006 policy change, the agency issued several advance income tax rulings on charity flow-through transactions at providers’ requests, indicating the strategy was within the letter of the law.

Asked about the legality of the charity flow-through approach, the Canada Revenue Agency said in an emailed statement it could not provide a general comment.

The spokesperson said the agency’s rulings on tax matters, often issued at the request of a client’s accountant, are specific to an individual’s circumstances.

Bernbaum and LeClaire said the strategy is entirely above board, however.

In 2011, the federal government made life more complicated for charity flow-through providers, rescinding the capital gains exemption on flow-through share donations.

The change was meant to limit the “excessive” tax benefits that resulted from providers combining the capital gains exemption and the flow-through share tax credits, according to the 2011 federal budget.

Despite the shift, however, several providers continued to promote the strategy as a highly tax-efficient way to give.

According to Bernbaum and LeClaire, donors commonly learn about charity flow-through from financial professionals or through word of mouth from others who have used the strategy.

Yet, some of the nation’s largest charities have also introduced donors to the practice.

Last year, a professional with charity flow-through experience volunteered with the Vancouver General Hospital & University of British Columbia Hospital Foundation, educating donors about the gifting approach as part of a foundation fundraising campaign.

One donor subsequently used the flow-through share method to make a $5-million, multi-year gift in support of urology health, according to foundation CEO Angela Chapman.

“There was definitely some gain of having that [volunteer] there informing others, [making] some people more comfortable with it,” she said.

Since 2013, the foundation has secured flow-through share gifts as large as $12 or $15 million, she added.

Across the country, the SickKids Foundation has also found success with flow-through share donations, raising about $4 million since 2008, according to Colin Hennigar, the foundation’s chief development officer.

When the foundation’s fundraisers meet with affluent benefactors to discuss how to give, they introduce charity flow-through as one of several gifting strategies, according to Hennigar.

If a donor is interested, a foundation fundraiser will provide a list of firms that arrange such deals and sometimes join an introductory call between a charity flow-through provider and a benefactor’s financial advisor to discuss the transaction, he said.

“It’s a niche group of individuals that use this giving vehicle, but we definitely promote it,” he added.

In a subsequent email, the foundation denied this, claiming flow-through shares are accepted by the foundation but not promoted.

Nationwide, several charities including the Princess Margaret Cancer Foundation, the Children’s Hospital of Eastern Ontario Foundation and Glenlyon Norfolk School, a Victoria B.C.-based private school, have also hosted information sessions about charity flow-through, introducing donors to the sophisticated giving practice, according to foundation staff and donors.

John Anzin, the Princess Margaret Cancer Foundation’s vice-president of finance, said sessions about charity flow-through are one of several the foundation has hosted, typically in Yorkville Hotels, educating donors and their advisors about sophisticated donation practices, such as gifts of life insurance or stock.

Anna Stanley, a University of Guelph assistant professor of geography who has studied flow-through share financing, said charities should be mindful of their role when introducing donors to charity flow-through.

Such promotion is accelerating the amount of available capital for mining exploration companies by broadening the pool of prospective investors to Canadian philanthropists, she said.

“[It] gives the exploration sector access to more people’s wealth.”

When a charity flow-through provider such as Wealth Creation Preservation & Donation helps a mining exploration company raise funds, they commonly email donors and fundraisers directly, alerting them to the new opportunity.

Hennigar and Chapman said if they have a donor they believe might be interested in donating via charity flow-through, they will forward the opportunity to the donor.

If the benefactor is interested, the charity flow-through provider will liaise with the client to purchase some of the mining exploration company’s shares on the day of the deal.

Within hours of the donor’s purchase, the donor will gift some of those shares to a charity.

Commonly, donors’ shares are gifted to a charity specializing in processing flow-through shares. These charities will later grant the funds at the donor’s direction to the benefactor’s intended end-recipient charities, such as the University of Ottawa.

Most clients who work with Wealth Creation Preservation & Donation donate their shares to the WCPD Foundation, a charity affiliated with its namesake tax planning firm, according to Jeff Todd, Wealth Creation Preservation & Donation’s vice-president of marketing.

Oberon Capital’s clients commonly work with the Conam Charitable Foundation, according to LeClaire. By email, the foundation’s president, Steven Roth, clarified that almost all of the donations the foundation receives are flow-through shares. Grants to recipient charities are thus predominantly the proceeds of such transactions.

Canada Revenue Agency data shows hundreds of charities have received such grants nationwide. Top recipients include public foundations such as the ZLC Foundation and Jewish Community Foundation of Montreal, donor-advised fund foundations, such as the Charitable Gift Funds Canada Foundation and Nicola Wealth Private Giving Foundation, and hospital foundations, such as the University Health Network Foundation and Ottawa Hospital Foundation.

Many of the charities contacted by Future of Good/The Narwhal that have received the largest amount in grant funding from the WCPD Foundation and Conam Charitable Foundation did not respond.

In emailed statements, spokespeople for United Way of Greater Toronto, Canadian National Christian Foundation, and Charitable Impact Foundation said they do not solicit flow-through share donations and have been passive recipients of grants from the WCPD Foundation and Conam Charitable Foundation.

The Mackenzie Health Foundation said when it receives a grant from the WCPD Foundation or Conam Charitable Foundation, the charity doesn’t have full knowledge of the origin of the funds.

When a foundation is gifted flow-through shares directly, they do not hold them for long.

According to Bernbaum, the day the donor purchases the shares, the recipient foundation or charity sells them at a pre-determined discounted price to a pre-arranged back-end buyer.

Purchasers are usually mining-savvy individuals or corporate investors, according to Wealth Creation Preservation & Donation’s Jeff Todd.

This approach prevents charities from needing to hold the shares long-term and enables mining investors to purchase the shares at a discount to the market price.

When the shares are sold to the back-end buyer, the charity provides the donor with a receipt for the amount the shares were sold for, plus the cost of fees charged by the charity flow-through provider, according to Bernbaum.

Providers typically charge six to ten per cent of the total amount raised for the exploration company on charity flow-through transactions, according to providers and charities. A charity flow-through raise of $10 million could thus earn a firm $600,000 to $1 million.

Though flow-through share tax credits are available to all Canadians, donors who leverage the charity flow-through strategy typically have an annual taxable income of more than $500,000, Bernbaum said during a fundraising conference presentation last April.

The strategy benefits Canadians with high incomes more because they pay more taxes.

Fundraising staff of two charities that spoke with Future of Good/The Narwhal said they do not do due diligence on the mining exploration companies whose shares they receive directly or indirectly via a grant from a foundation specializing in flow-through share transactions.

Instead, charities rely on flow-through providers to assess the mining exploration companies’ reputability and trust that federal and provincial laws ensure companies uphold good behaviour.

“It’s impossible for a charity to do due diligence on all of the mining sector. [It’s] not an area of expertise for us,” Julie Quenneville, CEO of the United Health Network Foundation, said.

“My area of expertise is health care, and my responsibility is to raise as much as possible to provide the best care to our Canadian population.”

At least some benefactors who use charity flow-through donations also do not heavily scrutinize the companies they invest in.

In 2022 and 2023, Ottawa real estate development professional Ray Charron participated in charity flow-through transactions, placing capital with a pair of companies exploring for uranium in the Athabasca Basin.

Before investing, Charron did not do much research into either company, he said.

“The company is the insignificant part of the entirety of the transaction.”

The Ottawa development professional felt comfortable with the transaction, he said, because of his trust in Wealth Creation Preservation & Donation.

PearTree Securities managing director Kendra Johnston said mining exploration companies they work with are put through an “extensive” due diligence process by the back-end investors who ultimately purchase flow-through shares.

She said each of these back-end investors have questions they ask, including about relationships with local Indigenous communities and environmental issues.

Bernbaum added that PearTree has “line of sight” into this due diligence process.

Donor Ray Charron said he has used the charity flow-through method because it has allowed him to give more to the Children’s Hospital of Eastern Ontario.

An investment of $70,000 in exploration company CanAlaska Uranium enabled Charron to make a $21,000 donation to Children’s Hospital of Eastern Ontario for just $4,200 after tax, he said.

Had he donated cash, the gift would have cost more than double.

In addition to the chance to make larger donations, some donors have also been motivated to participate in charity flow-through transactions by the opportunity to redirect the money they’d have to pay in tax to a preferred charity.

“One donor put it to me in an interesting way,” Trevor Mannion, chief advancement and enrollment officer at Glenlyon Norfolk School, said.

“‘You know what, at the end of the day, I’m really just diverting my tax dollars from the federal government to a charity of my choice,’” he said. “‘And really, making the impact of the dollars I’d be spending anyway on something that’s going to have a positive impact on my kid or on my family.’”

But though the complex donation strategy has helped benefactors gift hundreds of millions to organizations nationwide, Mining Injustice Solidarity Network’s Davis Matthews said such gifts are at odds with charitable sector values.

This is because they can be supporting prospectors and mining companies, which benefit from a regulatory system that allows firms to launch activity, without first obtaining the consent of impacted Indigenous people.

Nationwide, most provincial and territorial governments use a free-entry system to promote mineral exploration.

Davis Matthews said the approach is fundamentally colonial as it does not provide Indigenous rights holders with free, prior and informed consent — a set of principles codified by the United Nations and affirmed by the federal government in 2021.

Tensions around the free-entry approach have been exacerbated recently with a shift from in-person claims staking to digital.

In Ontario, Quebec, Saskatchewan and several other provinces and territories, mining exploration companies can now stake a claim with the click of a mouse from hundreds of kilometres away.

Last year, the Chiefs of Ontario, an organization that advocates on behalf of all 133 First Nations in Ontario, demanded the provincial government issue a year-long moratorium on digital mine claims staking, arguing claims were growing so rapidly that First Nations did not have the capacity to review and respond to each claim.

In Quebec, some First Nations have been similarly overwhelmed.

“There’s thousands of square kilometres of our territory that is all bought by people that bought those claims without our consent, without even consulting us,” Steeve Mathias, the former chief of Long Point First Nation, said.

Recently, Gitxaała Nation and Ehattesaht First Nation sued the province of B.C., arguing that the province’s online claims-staking system violated their right to consultation.

In a landmark decision in 2023, the B.C. Supreme Court agreed and ordered the province to develop a new approach within 18 months. In January, the government released the new process, but it has already been criticized by both First Nations and mining exploration firms.

Late last year, a Quebec superior court reached a similar conclusion as the judge in B.C. in a case involving Mitchikanibikok Inik First Nation (also known as the Algonquins of Barriere Lake).

The court found that for decades, the government failed to uphold its constitutional duty to consult with the First Nation prior to issuing mining claims on its traditional territory.

Two similar cases in Ontario are ongoing.

“First Nations are at a point where they’re saying ‘Enough,’ ” said Leslie Anne St. Amour, interim executive director of RAVEN, a charity that raises funds for Indigenous land defence.

“They’re trying to protect what is left.”

Asked whether flow-through share donations are at odds with charitable sector values, most charities named in this article did not respond directly.

Murray Palay, president of the GiftPact Foundation, a top recipient of flow-through share donations, said, however, that such gifts are consistent with the foundation’s values as their mission is to “facilitate philanthropy.”

It is difficult to know the scale of community resistance to mining exploration.

No research offers a comprehensive view of exploration projects in Canada and the responses they’ve received from local communities.

Oberon Capital’s David LeClaire said Indigenous push-back to projects they’ve helped finance is the exception, not the norm, and that the companies they work with try hard to develop positive relations with Indigenous people.

When asked about Indigenous opposition to projects Oberon Capital has helped finance via charity flow-through, the executive recalled just one instance: After years of First Nations blockades, the government paid the mining exploration company to abandon its project, he said.

While companies can commonly begin exploration with a mining claim, more disruptive activities typically require a permit to be issued by the provincial or territorial government.

Before a permit is granted, impacted Indigenous nations are often sent information about a company’s exploration plan and given the chance to comment. If objections are raised, the government will sometimes require a change in a company’s plan.

All three flow-through share companies said they only help finance companies that have received their permits from the government.

“If they have their permits, they have fulfilled their duty to consult,” LeClaire said.

Chris Frostad, CEO of exploration company Purepoint Uranium Group, agreed.

In 2022, Purepoint raised $3.5 million via a charity flow-through transaction to explore for uranium in the Athabasca Basin.

Frostad said the company is in the process of negotiating an exploration agreement with Ya’ thi Néné Lands and Resources — the formal way that three local Denesułiné First Nations and four municipalities offer their consent.

Still, he said, such express consent is not legally required.

“We have the consent — all the consents we need from the First Nations and from the Province to do the work in all of these areas,” he said.

“[First Nations] don’t have veto power on permits being handed out.”

Asked for additional details, Frostad said in a subsequent email that the company has never commenced exploration before contacting and discussing their plans with local leadership and responding to any questions or concerns they had.

Beyond issues of consent, Bernbaum and other charity flow-through share providers stress, in interviews with Future of Good/The Narwhal and presentations with charity audiences, that exploration offers well-paying jobs for Indigenous people and economic growth for northern communities.

Indigenous people working in mining made nearly double the amount earned by the average Indigenous worker in 2021 — $93,600 compared to $51,120, according to Statistics Canada data analyzed by the non-profit Indigenous Resource Network.

In an April 2024 presentation to charity professionals, Bernbaum said government tax expenditures spent subsidizing flow-through share investments catalyze northern jobs.

“A dollar of deduction in Toronto, holistically, is a dollar of exploration and taxable activity in Timmins,” he said.

Nicholson Jr. and other flow-through share providers also emphasize that despite the negative environmental reputation often associated with the mining exploration sector, the industry is green — and a vital part of a clean energy future.

In 2022, the federal government increased the tax relief available to investors who purchase flow-through shares from companies exploring for lithium, copper, uranium and other critical minerals used to make green technologies.

During a presentation at the same 2024 charity sector conference where Bernbaum spoke, Nicholson Jr. said charity flow-through is a tool to “save the world from climate change” because it helps companies discover urgently needed critical minerals.

In the old days, there was absolute environmental “ugliness” in the mining industry, but that has changed, said Bernbaum, in an interview with Future of Good/The Narwhal.

“The greenest community that I’ve ever met is the exploration mining sector. It’s astounding how concerned they are about the environment,” he said.

However, others say significant concerns remain.

Bruce Hanbidge, a strategic advisor with Ya’ thi Néné Lands and Resources, said the scale of mining exploration in the Athabasca Basin is contributing to the decline of caribou.

To search for uranium underground, companies sometimes cut vast metre-wide stretches through the forest to lay sensor cables. The practice provides companies with good data but creates a “10-year wolf highway,” making it harder for caribou to evade their predators, said Hanbidge.

Only three Athabasca Basin mining exploration companies contacted by Future of Good/The Narwhal responded to this allegation.

Company executives with Purepoint Uranium and Appia Rare Earths and Uranium Corp. said their work has never resulted in the decline of caribou populations.

Warren Stanyer, former president of ALX Resources, said his company does not use line cutting unless absolutely necessary in areas of thick brush. (ALX has recently been acquired by Greenridge Exploration, where Stanyer is now the company’s president.)

“The days of ‘blazing a grid’ are a thing of the past” due to improved technology, he said.

MiningWatch Canada, a non-profit advocacy organization, has also, however, raised concerns about the exploration industry’s impact on water in a 2023 report.

Companies commonly drill far beneath the ground to explore for resources, pulling up cylindrical cores that offer insight into the presence of minerals or metals.

However, while beneficial for exploration, MiningWatch national director Jamie Kneen said the activity can contaminate the water if drilling fluid is mismanaged, or if a drill hole connects contaminated and clean groundwater.

Asked about this allegation, just three Athabasca Basin mining exploration companies contacted by Future of Good/The Narwhal responded.

Tom Drivas, CEO of Appia Rare Earths and Uranium, said the company has not and will not drill near the vicinity of lakes and rivers.

Purepoint Uranium’s Frostad and Greenridge Exploration’s Warren Stanyer both said their companies’ exploration work has never resulted in water contamination.

Kneen said charities accepting or promoting flow-through share donations should be cognizant that mining exploration lays the foundation for developing mines, which have a significantly larger environmental impact.

While a company that develops a mine must now commonly raise sufficient funds to cover environmental remediation at the end of the mine’s lifecycle, RAVEN’s St. Amour said this is not always sufficient in practice.

“Those plans don’t necessarily account for accidents or disaster. Because if they were required to account for that, no one would be able to put up the money for it,” she said.

In 2022, the federal government estimated the cost to taxpayers of remediating the Giant Mine, a gold mine in the Northwest Territories, at $4.38 billion.

According to the federal government’s contaminated sites inventory, it’s the most expensive mine remediation project in Canadian history, but far from the only one requiring taxpayer funds.

As for the industry’s economic benefits, Ya’thi Néné Lands and Resources’ Garrett Schmidt said mining exploration boosts the economy in the Athabasca Basin, but added that the impact is modest and varies significantly by company.

According to data provided by companies to the non-profit, locals commonly comprise about 10 to 20 per cent of exploration team staff, with individuals typically working on short-term contracts as labourers, Schmidt said.

When it comes to procurement, some companies spend about 80 per cent of their total exploration budget locally on things like food, gas and accommodation, but others spend as little as 20 per cent, he said.

The difference typically comes down to which companies are hired for exploration camp catering and drilling, Schmidt said.

Purepoint Uranium’s Frostad said his company spends money locally where it makes sense, such as on gas and food, and has invested in training local workers to create cutlines. But for more complex services, like drilling or interpreting geophysical surveys, he said his company must look elsewhere.

Future of Good/The Narwhal provided Frostad with a summary of the range of concerns raised by other stakeholders about mining exploration’s impact on Indigenous people and the environment.

He said much of what was stated was “out of appropriate context, incomplete or incorrect.” Asked to clarify which statements he was referring to, Frostad did not respond by publication time.

Schmidt said there is a way forward for donors and charities concerned about the impact of flow-through share donations on Indigenous peoples or the environment.

In the Athabasca Basin, Ya’thi Néné Lands and Resources uses exploration agreements to ensure locals benefit from the work and companies avoid exploring environmentally sensitive lands.

Companies that sign exploration agreements with the local communities — Hatchet Lake Denesułiné First Nation, Black Lake Denesułiné First Nation, Fond du Lac Denesułiné First Nation and the municipalities of Stony Rapids, Uranium City, Wollaston Lake and Camsell Portage — agree to purchase and hire locally and pay a fee to the Athabasca Community Trust.

In 2023, money from the trust supported Black Lake Denesułiné First Nation students to take a graduation trip, funded water filtration systems in Uranium City and aided the repair and renovation of low-income and seniors’ housing in Wollaston Lake.

Eleven companies exploring the Athabasca Basin have signed such agreements, including at least five that have raised funds using charity flow-through — CanAlaska Uranium, IsoEnergy, Baselode Energy, Appia Rare Earths and Uranium and Greenridge Exploration.

Schmidt said such companies are leaders among their peers.

However, more than a dozen other companies exploring the region, including at least seven that have raised money via charity flow-through, have not signed such agreements.

According to a Future of Good/The Narwhal analysis, these firms — Purepoint Uranium, Atha Energy, Basin Uranium, Cosa Resources, Global Uranium, Skyharbour Resources and F3 Uranium — have collectively raised at least $84 million via charity flow-through.

When charities help companies who haven’t signed exploration agreements to raise funds, Schmidt said it’s a “net negative” for the community because it impacts the land while locals get little benefit.

Before participating in or receiving funds through a charity flow-through deal, Schmidt said donors and charities should ask for proof of consent from impacted First Nations through an exploration agreement or otherwise.

He said that without doing so, they may be participating in something that isn’t fair and isn’t having the impact they’re hoping for.

Future of Good/The Narwhal provided all charities and donors named in this article with a summary of the key concerns raised by Schmidt and others.

Asked if they plan to continue to participate in flow-through share donations, the vast majority did not respond directly.

Those that did — the Mackenzie Health Foundation, GiftPact Foundation and Ottawa-based donor Raymond Charron — said they plan to continue to participate in charity flow-through transactions.

“My only goal is to support my local community to the fullest extent possible; Wealth Creation Preservation & Donation has given me that opportunity,” Charron said.

Asked if they plan to inquire if companies have First Nations consent before promoting or receiving a flow-through donation, most charities did not say.

The Mackenzie Health Foundation and GiftPact Foundation said they do not plan to request this information from mining companies or third-party foundations.

They said they trust the due diligence being performed by charity flow-through providers, such as Wealth Creation Preservation & Donation and PearTree Canada.

“We believe that the requirement of consent by First Nations regarding the issue of mining permits is important but should more properly be addressed by provincial and federal governments,” GiftPact’s president Palay said.

The Canadian National Christian Foundation said they had not been aware of the concerns raised but would take it “into consideration.”

A spokesperson for United Way Greater Toronto said the charity is already undertaking a review of its gift acceptance policies to ensure they are values-aligned and reflect the “evolving landscape of philanthropy.”

The Narwhal accepts charitable donations, including securities through CanadaHelps. At no point does CanadaHelps disclose the details of the securities being donated. The Narwhal has not knowingly accepted donations of flow-through shares from any mining exploration companies. The Narwhal has not received donations from Wealth Creation Preservation & Donation Foundation or Conam Charitable Foundation.

Updated on March 26, 2025, at 7:08 p.m. MT. Due to an editing error, this story misspelled Warren Stanyer’s name in one instance. The correct spelling is Stanyer.

Get the inside scoop on The Narwhal’s environment and climate reporting by signing up for our free newsletter. When I visited my reserve, Moose Factory,...

Continue reading

Xatśūll First Nation is challenging B.C.’s approval of Mount Polley mine’s tailings dam raising. Indigenous...

Financial regulators hit pause this week on a years-long effort to force corporations to be...