Hope for a huge, ancient and imperilled fish

First Nations are leading efforts to make sure lake sturgeon can find a home in...

Over the past 10 years, the Yukon government has collected a mere 0.03 per cent of the value of placer and quartz resources on behalf of all Yukoners, the rightful owners of those minerals.

An independent panel appointed by the government to review the territory’s mining legislation found that, during this period, miners extracted minerals worth an average of $335 million per year yet only paid an average of $100,000 per year in royalties.

The two laws predominantly responsible for mining in the territory, the Placer Mining Act and the Quartz Mining Act, were established in the late 1800s during the Klondike Gold Rush era and are in serious need of modernization, according to the panel’s recent strategy report, which is based on years of public engagement and is intended to inform the Yukon government’s efforts to bring Yukon’s mineral development legislation into the 21st century.

Yukon’s antiquated royalty rates for gold — set into law in 1906 — are famously low at just 37.5 cents per ounce of gold, based on a per-ounce price of $15. In today’s market, one ounce of gold is worth more than $2,300.

“The royalty regime is very old, and it has not been updated in a significant period of time,” Math’ieya Alatini, a member of the independent panel, told The Narwhal. “We have to bring the royalty regime up to date and make it commensurate with the value of the minerals that are being removed.”

Low royalties are something of a sore spot for many in Yukon, including members of the public, First Nations and miners themselves, who argue their industry provides the territory with a cascade of economic benefits not necessarily reflected by royalties. In order for mining to remain sustainable and profitable and continue to have social buy-in, the panel recommends the Yukon government make some key changes to ensure the benefits of mining are more equally distributed through changes to the royalty regime and, potentially, through new taxes.

Over the past decade, Yukon has seen a resurgence of mining interest, especially for gold extracted through placer mining operations. According to

the Yukon Geological Survey’s latest comprehensive report on placer mining, published in 2018, there are 25,219 placer claims in the territory, the highest number dating back to 1973.

Placer mining involves removing rocks and gravel from streams and wetlands in search of gold and can cause disturbances in water quality that can impair the feeding and reproduction of fish. Over many years, placer mining can destroy irreplaceable wetlands, disrupt waterways and harm unique riparian ecosystems that connect land and water. And although placer mining occurs exclusively in streams and Yukon’s wetlands, there are no specific protections in place to protect these unique ecosystems from this kind of activity.

Yukon’s modern gold rush, popularized in reality TV shows like Gold Rush and Yukon Gold, has been facilitated by new technologies, machinery and industrial techniques that are a far cry from the humble gold pan of the 1890s. And while the pace and scale of placer mining operations has evolved in recent years, the royalty scheme has not.

“There are going to be detrimental effects [from mining],” Alatini said, noting the resources being harvested are fundamentally nonrenewable. “These minerals are not going to be returned to the ground. … How do we adequately compensate this generation and future generations for the loss of use?”

Read more: Yukon wetlands pushed to tipping point by placer mining, First Nation and conservationists say

The panel suggests the government act on recommendations first made by the Yukon Financial Advisory Panel in 2017 to carry out a comprehensive review of mining policies “with a particular emphasis on ensuring fair and efficient royalty rates.”

Based on the findings of that review, the Yukon government should modernize mining legislation “to ensure all Yukoners receive fair and meaningful financial returns from mining activities while also ensuring competitiveness with other Canadian jurisdictions,” the panel said.

One of the primary ways the panel recommends altering the royalty system is by adjusting royalties based on the profitability of individual mining operations. A profit-based placer gold royalty would require higher royalties from more profitable operators, while “placer operations that are truly marginal in terms of profitability will continue to pay essentially no royalties.”

The panel also suggests the Yukon government consider charging more royalties from non-Yukoners — miners who might simply show up to cash in on high market gold prices — than from local operators who are there for the long haul.

Read more: Gold seekers are flooding into the Yukon and wreaking havoc on its rivers

Royalties don’t represent the only way Yukoners and Yukon First Nations might benefit from mines, however. The panel points to new forms of taxation that could improve mining standards, provide social benefits to local communities and generate greater rewards for local mine workers over itinerant workers at mines.

Currently, Yukon does not charge mine operators anything for the use of water. An industrial water charge, similar to that introduced in British Columbia in 2016, could be used to generate revenue from mines and also create incentives for miners to keep water clean. The panel recommends the government introduce a rolling water tax that rewards operators for maintaining high water quality.

Tyler Hooper, a spokesperson with the B.C. Ministry of Forests, Lands, Natural Resource Operations and Rural Development, recently told The Narwhal that all licensed surface water and groundwater users are required to pay annual water rents. The rental rates are variable and can exclude small-scale placer mining operations. But according to a B.C. provincial government list of example rates, a mine that uses 1.2 million cubic metres of water per year would be charged $2,500 annually or $2.08 per 1,000 cubic metres.

Lewis Rifkind, mining analyst for the Yukon Conservation Society, previously told The Narwhal the recommendation to roll out a water tax was welcome, but added he would need more detail to understand how such a fee would work in Yukon.

“How will it be applied? Will it be different for quartz exploration to a quartz mine to placer mining?”

The panel’s report does not go into any detail regarding these matters nor the particulars of how a water tax could be applied to various mining operations in Yukon.

Water licences for mines are issued by the Yukon Water Board and there are more than 100 granted to placer miners in the Indian River watershed directly south of Dawson City, Yukon, alone.

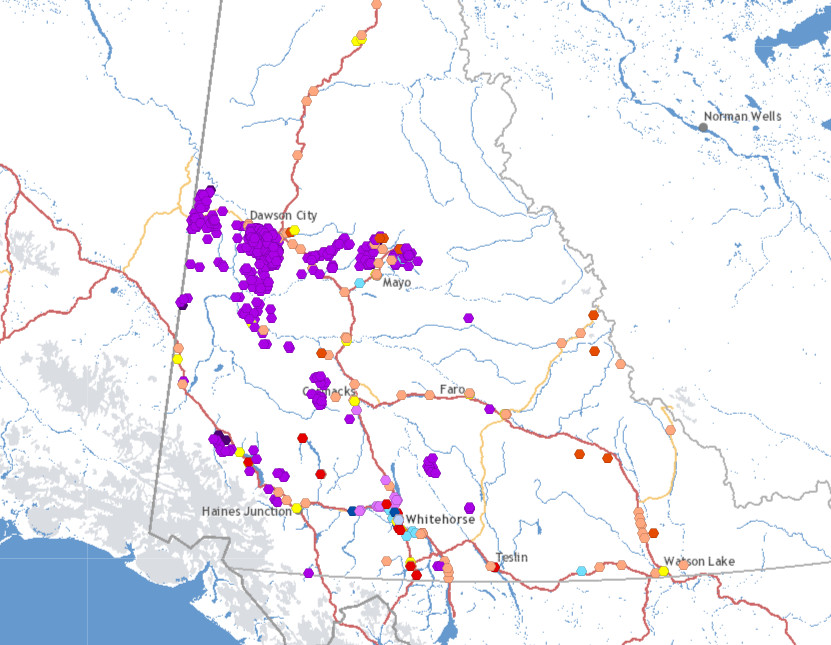

A map showing the location of water licenses in Yukon. The purple dots indicate water licenses for placer mining. Photo: Yukon Government

Rifkind expressed concern that a water tax could simply be added to the general cost of doing business rather than act as a true incentive to improve mining practices and keep water clean.

The panel also recommends applying a payroll tax to people who work but don’t live in Yukon. Right now, personal income tax corresponds with the jurisdiction in which out-of-territory workers live.

“It would allow a sort of prorated amount to be transferred back to the Yukon,” she said, adding that a large portion of Yukon’s workforce is made up of people from other jurisdictions. “We want to make sure some of that money stays in the Yukon to act as a multiplier for the economy.”

The payroll tax would be deductible for Yukon residents, the strategy states.

Read more: Canada’s mining giants pay billions less in taxes in Canada than abroad

Taken together, the water and payroll taxes could help buoy a heritage fund — money that would be held in trust to benefit future generations.

Alatini said the creation of a heritage fund would not only recognize the value of the resources extracted from Yukon, but also capture some of that value for Yukoners “that translates from the work that’s being done in their backyard to something that can benefit everyone that is here.”

“A Yukon heritage fund would provide a visible link between mining activity, royalty revenues from mining and long-term prosperity in Yukon, thereby enhancing sustainability and the industry’s social licence to operate,” the strategy states.

Through Yukon’s modern treaties, self-governing Yukon First Nations are able to receive royalties collected by the Yukon government. But because the territorial government receives such low royalties to begin with, only a “negligible amount” is actually making its way to First Nations, the panel found.

Alatini said the creators of Yukon’s Umbrella Final Agreement — a political agreement struck between Yukon First Nations and the Yukon and federal governments — “had contemplated First Nations receiving a portion of the benefits of the resources that are being taken from their traditional territories — full stop,” Alatini said.

The average royalty cheque received by First Nations during the past decade ranged between $6 and $24, Alatini added.

Tr’ondëk Hwëch’in First Nation, on whose territory the vast amount of Yukon’s placer mining takes place along the Indian River, reported receiving a royalties cheque from the government for $65 in 2017. That same year, placer mining along the Indian River accounted for 50 per cent of total placer gold mined in Yukon, according to the Yukon Geological Survey, amounting to more than 350,000 crude ounces of gold.

The panel recommends that “Yukon First Nations receive a fair financial and social return from mining and exploration within traditional territories by strengthening the connection between revenue flows and Indigenous interests in the land itself.”

Recommendations from the panel also include allowing First Nations, under their final agreements, to charge companies directly for water use or land rental fees, instituting a statute-based template for benefit agreements with affected First Nations and requiring both impact and benefit agreements in advance of quartz mine development, construction, production and decommissioning.

Carl Schulze, secretary treasurer for the Yukon Prospectors Association, told The Narwhal industry isn’t thrilled about the idea of paying more taxes, noting that Yukon’s economy is stimulated just by virtue of mines being located in the territory.

“What you’ve got to think about is there’s still the supply chain, service chain, all the employees, all the distribution,” Schulze said. “If you took just payroll for Yukoners, and what you paid your contractors, you know, whoever trucks the ore, whoever supplies geological services, local legal services, anything like that, I mean, it’s an enormous amount of money.”

The Klondike Placer Miners’ Association has also been a vocal opponent of increased royalty rates for years, with former association president Mike McDougall suggesting increased royalties would undercut the profitability of placer mining operations, which he likened to the “family farm.”

Despite dissatisfaction over low royalties from members of the public, First Nations and miners themselves, the mining industry in Yukon averse to paying more taxes, saying the mere presence of mines in Yukon stimulates the territory’s economy. Photo: Malkolm Boothroyd / CPAWS Yukon

But in addition to industry opposition, there are other potential challenges to introducing new and increased revenue generators from mines in Yukon, most notably the territory’s transfer payment from Ottawa.

Under the territorial formula financing arrangement, Yukon receives federal funding every year to pay for public services. But in order to maintain this funding arrangement, the Yukon government can only collect and keep $6 million worth in resource revenues each year.

“For every dollar above that $6 million amount, a dollar is deducted from Yukon’s [territorial formula financing] grant,” Eric Clement, director of communications with the Yukon government’s Department of Finance, told The Narwhal in an email.

That $6 million ceiling may present challenges to Yukon moving forward with some of the most ambitious recommendations of the independent panel, including the creation of a heritage fund.

Six million dollars in resource revenues is simply “too low to capitalize a Yukon heritage fund,” the panel noted in its report.

Other arrangements could alleviate Yukon’s $6 million limit, however. The panel suggests Yukon look to the Northwest Territories’ arrangement with the federal government, which allows that territory to keep up to 50 per cent of its resource revenues without a specific cap. If implemented in Yukon, this arrangement would allow the territory to receive roughly $54 million in resource revenues without being forced to forego federal support, the panel found.

Alatini said new arrangements might be necessary to re-envision how Yukon generates and holds onto resource wealth. A new agreement would require “that the Yukon government and Canada come to the table,” she said. “We need to have consistently producing mines in order for this to even be an option.”

Updated on Feb. 25, 2021 at 5:40 p.m. PST: Over the past 10 years, the Yukon government has collected 0.03 per cent of the value of placer and quartz resources, not 0.3 per cent as previously stated.

Get the inside scoop on The Narwhal’s environment and climate reporting by signing up for our free newsletter. Angello Johnson’s shoulders burn, and his arms...

Continue reading

First Nations are leading efforts to make sure lake sturgeon can find a home in...

We’re excited to share that an investigation by The Narwhal is a finalist for the...

A new documentary, Nechako: It Will Be a Big River Again, dives into how two...