The headlines don’t stop. “Oil crashes to fresh 18-year low.” “Crude-oil prices post the largest quarterly percentage drop on record.” “Canada is first price-war casualty.”

As the COVID-19 pandemic leaves its mark on lives and economies across the globe, Alberta’s already-volatile oil industry is gearing up for another storm as oil prices around the world plummet.

Recently, some types of oil have even traded at negative oil prices.

Negative. Oil. Prices.

It’s what Alberta Premier Jason Kenney called a “triple whammy — the pandemic, the recession and the oil price crash.”

At the same time, Kenney has announced a $1.5-billion investment in a multinational pipeline company to build the controversial Keystone XL pipeline to the U.S. Gulf Coast, and the federal government is reportedly floating plans for a $15-billion bailout of the industry.

Oil and gas producers have asked governments to consider investing public funds into their private companies — not unlike what was done to try to shore up auto companies in the last major recession.

With so much news flying around, we wanted to take a couple steps back and clear up a few basic questions.

Why are oil prices so low? How can an oil price be negative? And what the heck is “homeless crude?”

Read on.

1. So is this the lowest oil prices have ever been?

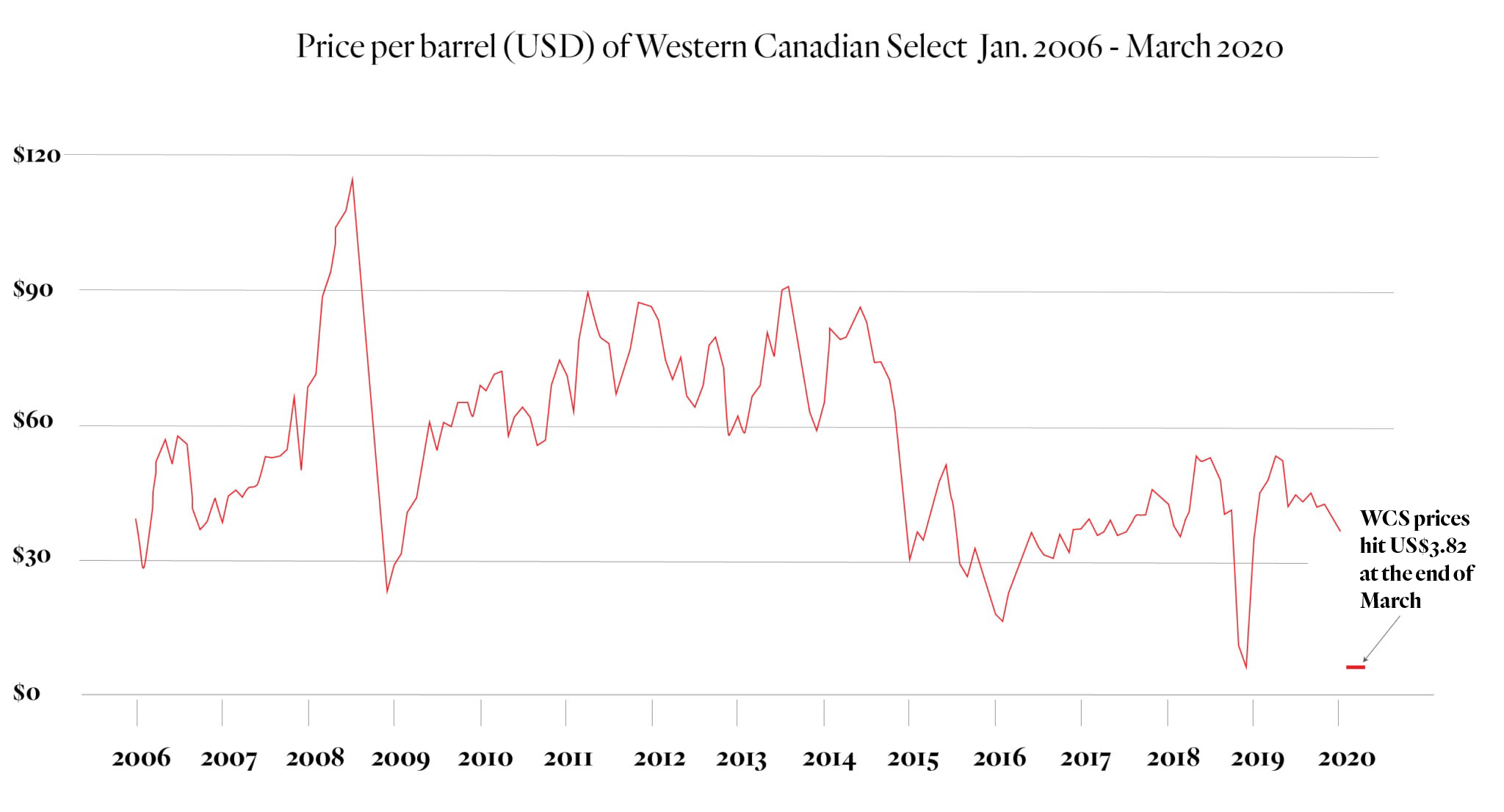

When we talk about Alberta’s crude oil — specifically, bitumen from the oilsands — we look at a benchmark price called Western Canadian Select (WCS). And while Western Canadian Select has been low before, it’s never been quite this low.

Western Canadian Select dipped down to US$3.82 per barrel on Monday. There are 159 litres in a barrel of oil, so that’s just over two cents per litre.

In the past, Western Canadian Select had been as low as US$5.97 per barrel. That was back in December 2018, according to data from the Government of Alberta.

Western Canadian Select prices. Source: Alberta government. Graph: Carol Linnitt / The Narwhal

2. Is the price of oil so low because of the pandemic?

The pandemic certainly hasn’t helped oil prices, as demand is plummeting (think fewer flights, less driving, less economic activity in general).

But the real price crunch is the result of a long-simmering price war.

The basics tenets of supply and demand make it obvious that prices go up when supply is low. So for years, major oil-producing countries like Saudi Arabia, a member of the Organization of the Petroleum Exporting Countries (OPEC), and Russia, not a member, have been trying to agree to reduce supply (i.e. sell less) to keep prices high.

But in March, that all changed. Saudi Arabia essentially said “to hell with this” and started increasing supply again. Prices plummeted as expected (thanks, econ 101!).

3. But why would Saudi Arabia flood the market with cheap oil? Isn’t it ultimately losing, too?

While Saudi Arabia and Russia have been trying to curtail supply to keep prices higher, the trouble is, not everyone has been on board with that strategy (ahem, the United States).

Crude oil production in the U.S. has doubled in less than 10 years, according to data from the U.S. Energy Information Administration. This meant Saudi Arabia and Russia were trying to curb their production while the U.S. was still “going gangbusters” with production, according to Clark Williams-Derry, a Seattle-based energy finance analyst with the Institute for Energy Economics and Financial Analysis.

That meant the supply was staying high — and the prices were staying low.

As Jeff Rubin, former chief economist of CIBC World Markets, put it, “Saudi Arabia did what is the rational course of action for the lowest-cost producers.”

“[It said,] ‘If we’re going to a price war and I’m the lowest-cost producer, I’m turning open the spigot.’ ”

So that’s what it did.

It flooded the market, because even at a low oil price, the low cost of its production means it can still make money. According to Rubin, the cost of production in Saudi Arabia is easily a tenth of what it is in Alberta’s oilsands.

So while Saudi Arabia is losing out compared to what it would have made had prices stayed high, it is still making money.

Alberta, on the other hand, is in a different boat. Oil from the oilsands costs more to produce and sells at a lower cost than much of its competition.

4. Why is Alberta’s oil worth so much less?

“We talk about oil as if it’s one thing. But it’s actually a range of things, a mixture of hydrocarbons,” Williams-Derry explained to The Narwhal last month. “Each barrel of oil is its own thing.”

Alberta’s crude is different from oil produced elsewhere.

Alberta has two main disadvantages: location (we’re landlocked) and the quality of oil produced (thick like cold molasses).

“You’re talking apples and oranges,” Rubin explains. “One is a much lower quality oil.” That’d be Alberta’s.

That creates what’s known as the price differential — the discount Alberta crude is sold at compared to the common North American benchmark, West Texas Intermediate (WTI).

So while West Texas Intermediate trades at around US$20 per barrel, Western Canadian Select can dip much lower — even to under US$4 per barrel.

Work is expected to slow down in the Alberta oilsands, due to a plunge in world oil prices. Photo: Alex MacLean

5. Under US$4 per barrel of oil is less than a bottle of maple syrup. How low can oil prices go?

Very low.

Oil prices depend on a lot of things — and it’s important to remember that benchmarks like Western Canadian Select are just that: benchmarks. But with so much oil flooding the market right now, prices are being driven down dramatically, to the point that a barrel of oil can be “functionally worthless” once production and transportation costs are factored into the equation.

And in some areas, that could even mean the oil price could be negative.

6. What on earth is a negative oil price?

Last week, Bloomberg reported that some “producers are actually paying consumers to take away the black stuff.”

That was after another benchmark oil price, Wyoming Asphalt Sour, a type of oil blend used to make paving bitumen, was reportedly trading at -19 cents U.S. per barrel.

As CBC pointed out, Wyoming is not unlike Alberta — in that it is landlocked — leaving some to wonder if Western Canadian Select is also going to be pushed close to a valuation of zero … or less.

These fears aren’t just held by oil price analysts — Alberta Premier Jason Kenney has reportedly speculated that the price of Western Canadian Select could drop into the negatives in a matter of weeks.

7. Why are we still paying 60 cents per litre for gas in Alberta if oil is worth basically nothing these days?

Gasoline prices in Alberta have fallen to roughly half of what they were at this time a year ago, with some gas stations in the province reporting prices in the 55-cent range, according to Gasbuddy.com.

But don’t expect gas prices to be negative anytime soon.

The stuff we put in our cars is very different from the thick molasses pulled out of the ground at an oilsands mine. Refinery and transportation costs play a big role in gas prices, as do taxes. And don’t forget the gas station itself wants to make a few bucks, too.

It’s a bit like buying a loaf of sourdough from the bakery. Yes, we have wheat growing next door, but that doesn’t do most of us a lot of good when we want to make a sandwich.

We can, however, likely expect to see gas prices stay low as the price of crude oil stays down.

8. Can’t companies just store oil until prices go back up?

You’d think companies could just hold on to their oil if the prices they’re fetching aren’t worth it.

But too much oversupply around the world can mean storage options simply run out.

There are serious concerns right now this might already be happening. As CNN put it, we’re in the midst of “a supply glut so epic that the world will soon run out of room to store all the unneeded barrels of oil.”

And according to reports from The Financial Post, “by June there’ll be no place left to put the unwanted crude.”

This has led to a new kind of crude: “homeless crude” — oil that has no place to go.

No one wants to sell it at such low prices, but increasingly they can’t find anywhere to store it, either.

That means companies are thinking of creative ways to store their excess supply, including buying tankers to use as floating storage. One energy analyst has suggested 20 per cent of the global fleet of what are known as “very large crude carriers” could be used as floating storage — but even that wouldn’t offer enough space to store all the unwanted oil.

And in the meantime, the cost to store oil on a supertanker has skyrocketed.

But with so much excess supply and so little (affordable) storage, the only option for many producers is to sell their oil. That means even lower prices.

Eventually, producers are forced to stop producing.

9. So can’t Alberta just turn off the taps for a while?

Not really — especially not in the oilsands, where huge mining operations can’t simply be turned off with ease.

“It’s not nimble,” Rubin said of the oilsands industry, noting that the huge staff and capital investment make it more difficult and expensive to halt production at an oilsands mine than at more conventional wells or U.S. shale production, which can be temporarily suspended at a lower cost.

In other types of oilsands production that involve steam, there are added concerns that turning off production can hinder the ability of a well to produce oil in the future.

Then there are the economic worries.

“Alberta can’t just afford to shut it all down,” Rubin told The Narwhal. “There are consequences for people, not just who work in the oil industry, but who require the spending of people who work in the industry. So let’s try to salvage what we can.”

This is what has governments nervous — figuring out a way to prevent a total economic collapse, while taking into account the long-term challenges the industry already faces, including serious concerns about climate impacts.

10. Will more pipelines solve this problem?

As Rubin put it to The Narwhal last month, he believes completion of the Trans Mountain pipeline expansion project would be a “lifeline,” not a panacea, for the struggling oil and gas industry.

“The notion that Asia is desperately waiting for Canadian bitumen is a fantasy,” he said, adding that he believes while more pipeline capacity would ease some of the pressures on the price for Alberta’s crude, it would by no means make the high-cost product into something high value, especially when compared to what’s available in the rest of the world.

So that leaves the question on the table — what is the future of Alberta’s oilsands industry and the thousands of workers employed within it?

Like what you’re reading? Sign up for The Narwhal’s weekly newsletter.