This is a guest post by Mark Jaccard, one of Canada's most distinguised sustainable energy economists, and was originally published on his blog, Sustainability Suspicions.

Why is Alberta’s policy a regulation and not a tax?

Alberta’s government officially says it doesn’t have a carbon tax, and I agree. But if I had a dollar for every time I’ve heard someone claim it does, I could buy a lot of anti-oil sands ads, and maybe a politician along the way.

I hear about Alberta’s so-called carbon tax from business people, politicians, journalists, environmentalists, sometimes even economists (who should know better). But the policy in question is, in fact, a “performance regulation,” that sets a maximum “emissions-intensity” for industries, and fines them $15 for each tonne of CO2 emissions in excess of that maximum.

The way it works is that government picks a base year, say 1990, and tells an industry it must achieve a percentage reduction in the amount of CO2 it emits for each unit of its output, be that oil, steel, electricity, petrochemicals, paper, whatever. If the industry in question is a coal-fired power plant, the regulation requires a percentage reduction in CO2 emissions per kilowatthour generated. If the industry is an oil sands facility, it requires a percentage reduction in CO2 emissions per barrel of oil produced.

If the industry satisfies the performance regulation – achieves the required percentage reduction in emissions-intensity – it pays nothing. But if it fails to comply completely, then it must pay the $15 fine for each tonne of excess CO2. (For simplicity, I ignore additional complexity in the Alberta policy that allows firms to avoid the fine by (1) buying credits from industries who “out-perform” their performance regulation, or (2) purchasing offset credits from unregulated entities, like farmers, who ostensibly reduce their emissions.)

Note the stark contrast with the carbon tax. The tax is levied on all emissions – the more you emit, the more you pay. With the performance regulation, emissions are free as long as an industry achieves its required percentage reduction in emissions-intensity. Its emissions could even rise dramatically and still be free of any charges.

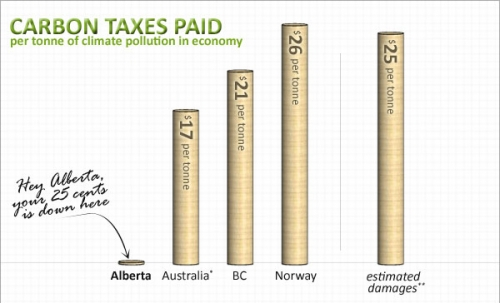

VisualCarbon.org's Barry Saxifrage shows how Alberta's carbon tax measures against those of other provinces and countries for the Vancouver Observer.

A look at the oil sands industry in aggregate shows this. From 1990 to 2011, emissions from Alberta’s oil sands almost quadrupled, from 15 million tonnes to 55 million. At the same time, the industry’s emissions-intensity (CO2 per barrel of oil produced) declined 26%, mostly because of technological innovations. If a performance regulation had required a 25% emissions-intensity reduction over this period, then all emissions would have been in compliance, and therefore free of charges – even though carbon pollution had increased enormously.

So why would anyone confuse Alberta’s regulation with a carbon tax?

My 25% example suggests a performance regulation that is “non-binding” – it imposes no costs on an industry because the required emissions-intensity reduction is less than the reduction that would have happened anyway. But what if the regulation is binding? What if an industry finds that it must either spend money to reduce its emissions or pay fines for its excess emissions?

This is, in fact, the case with Alberta’s regulation. Starting in 2007, it required large industries to reduce their emissions-intensity by 12%, with additional intensity reductions over time. Between 2007 and 2012, regulated Albertan firms paid over $300 million in fines for non-compliant emissions – into what the government calls a “technology-fund.” And they have undoubtedly also spent money to reduce their own emissions wherever such expenditures were cheaper than paying the fine of $15 per tonne. (Again, I ignore for simplicity purchase of offsets.)

Because its performance regulation is binding, Alberta’s $15 fine for non-compliant emissions appears to replicate the effect of a carbon tax. Firms facing a $15 carbon tax are motivated to reduce emissions wherever the cost of doing so is less than the cost of paying the tax. Likewise, firms facing a $15 non-compliance fee under Alberta’s performance regulation are motivated to reduce emissions wherever the cost of doing so is less than the cost of paying the fee.

And this is why some people call Alberta’s performance regulation a form of carbon pricing, even carbon taxation. Some people have even equated Alberta’s carbon price of $15 per tonne of CO2 with BC’s $30 carbon tax, and suggested that if Alberta increases its fine for excess CO2 emissions to $40, as has been discussed, its effort to reduce carbon pollution will exceed BC’s.

But this is not true. It’s an attractive claim, if you are trying to get rich by rapidly and dramatically expanding oil sands output in Alberta. But it’s not true. The reason is that a carbon tax is applied on all emissions whereas the Alberta non-compliance fine is only applied on a small percentage of emissions. So the two policies have dramatically different effects on the total cost of production of an emissions-intensive industrial activity, like producing oil from oil sands. And the Alberta oil industry and the Alberta government know this well.

Why tax all carbon pollution instead of just “non-compliant” carbon pollution?

An extreme case helps make this clear. Suppose that Alberta’s performance regulation required an immediate 100% decline in emissions-intensity (meaning zero carbon pollution), and levied a fine of $30 on all non-compliant emissions (without offsets or other escape options). In this case, its effect would be identical to BC’s current carbon tax. De facto, it would be a carbon tax in that each and every tonne of emitted CO2 would require payment of $30.

Now, imagine that you wanted to build a new oil sands facility that you hoped would be profitable – meaning that its average cost of production would be lower than the market price garnered by oil from the oil sands. Unless you had a technology up your sleeve that would eliminate CO2 emissions at a much lower cost, your cost of production could increase by as much as $30 for each tonne of CO2 emitted. According to experts, this could add $4 to the production cost of a typical barrel of oil from the oil sands.

In contrast, if the $30 were only applied to 12% of emissions, in the case where a firm had no lower cost options to reduce emissions with Alberta’s current policy, then the effect would be to increase the production cost of each barrel of oil by 50 cents.

At today’s oil prices, the difference between $4 and 50 cents might seem piddling. But what happens if we take our political leaders at their word when they promise to do everything they can to prevent global temperatures from rising more than 2 °C, as Stephen Harper promised at a G20 meeting in 2009, and again at the Copenhagen climate summit later that year? Modeling by Canadians (often modelers associated with me I confess) and various international teams at MIT, University of Maryland and other institutes in Europe show that the planet would need something like a global carbon tax (on all emissions) of $100 in 2020 and $200 in 2030. This could increase the production cost of each barrel of oil by $12 and $24 respectively.

What is the likely effect of politicians keeping their climate promises on oil sands production?

Carbon pollution charges at this level would cause a significant increase in the cost of producing oil from the oil sands. And its effect on oil sands profitability would be devastating because, at the same time, the international price of oil should be falling. As humanity shifts away from gasoline and diesel in order to reduce CO2 emissions, the demand for oil would fall, which in turn would cause a falling price. The net effect? No oil sands.

In 2010 and again in 2012, a world-leading team of global energy analysts at MIT found that oil sands expansion makes no sense in a world that stays within the 2 C limit. In 2010 and again in 2012, researchers at the International Energy Agency got essentially the same result. Current oil sands production can continue for decades. But expansion makes no sense. As the MIT team noted, "The niche for the oil sands industry seems fairly narrow and mostly involves hoping that climate policy will fail."

One way for climate policy to fail is by having none. Another is to have climate policy that looks to have more effect than it actually does. Alberta’s performance regulation is a good example.