In a Nova Scotia research lab, the last hope for an ancient fish species

Racing against time, dwindling habitat and warming waters, scientists are trying to give this little-known...

A new study published today in the journal Nature finds the vast majority – 99 per cent – of Canada’s oilsands are “unburnable” if the world is to avoid a global temperature rise of more than 2 degrees Celsius.

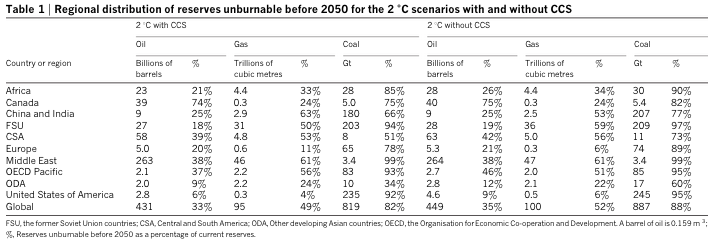

The study, co-authored by Christophe McGlade and Paul Ekins, also found over 80 per cent of the world’s current coal reserves and half of all gas reserves similarly need to remain unused.

Given changing market conditions that are already making the production of expensive and carbon-intensive fossil fuel reserves – like oilsands crude – more difficult, the authors concluded that a concerted effort to limit global warming would result in a massive drop in Canadian oil production.

The extraction of bitumen would “drop to negligible levels after 2020 in all scenarios because it is considerably less economic than other methods of production,” the report states.

The use of in situ mining and carbon capture and storage (CCS) to limit greenhouse gas emissions from oilsands production would only slightly move the needle, according to the study, with a total of 85 per cent still remaining unburnable despite these efforts. The authors also predict CCS, a process both the government of Canada and the oil and gas industry are increasingly relying on, will have a limited role to play in a world taking action to limit global warming.

“Because of the expense of CCS, its relatively late date of introduction (2025), and the assumed maximum rate at which it can be built, CCS has a relatively modest effect on the overall levels of fossil fuel that can be produced before 2050 in a 2C scenario.”

The authors argue that keeping within that 2C target will require an entirely reworked relationship with carbon and a concerted effort to keep reserves underground.

“A stark transformation in our understanding of fossil fuel availability is necessary,” the authors write in the paper’s conclusion, adding, “in a climate-constrained world…large portions of the reserve base and an even greater proportion of the resource base [recoverable under current economic conditions] should not be produced if the temperature rise is to remain below 2 degrees Celsius.”

The new research for the first time uses a single integrated model to analyze the world’s oil, gas and coal reserves and what portion of the remaining global ‘carbon budget’ countries might claim given the type and location of their reserves.

Within their analysis McGlade and Ekins found the Middle East holds over half of the world’s unburnable oil and that Canada has the lowest utilization of its deposits – the majority of which are buried in bitumen stores – while the U.S. has the world’s highest.

Coal is by far the most restricted fossil fuel resource in the study with 82 per cent of global resources remaining unburned before 2050.

The region assignment of unburnable reserves can be seen in the chart below:

However, as the study’s authors point out, global fossil fuel reserves surpass that number by three times.

Given the urgent need to limit the use of current resources, the study makes the point that policy action on climate change would “render unnecessary” the continued exploration of new fossil fuel reserves.

As DeSmog Canada recently reported, G20 nations spend around $88 billion annually to explore for new coal, oil and gas reserves.

A report produced by the Overseas Development Institute and Oil Change International notes this level of investment for carbon stores that may never be exploited creates a “triple-loss” scenario by investing in potentially stranded fossil fuels, diverting investment from alternative energy, and undermining an ambitious climate deal in 2015.

“In 2013, fossil fuel companies spent some $670bn (£443bn) on exploring for new oil and gas resources. One might ask why they are doing this when there is more in the ground than we can afford to burn,” study author Paul Ekins told The Guardian.

“The investors in those companies might feel that money is better spent either developing low-carbon energy sources or being returned to investors as dividends,” said Ekins.

Image Credit: Oilsands operations by Kris Krug.

Get the inside scoop on The Narwhal’s environment and climate reporting by signing up for our free newsletter. On March 17, federal Conservative Leader Pierre Poilievre...

Continue reading

Racing against time, dwindling habitat and warming waters, scientists are trying to give this little-known...

From investigative reporting to stunning photography, we’ve been recognized with four 2024 CAJ Awards nods...

The Narwhal is expanding its reach on video platforms like YouTube and TikTok. First up?...