Two blank cheques: are Ontario and B.C. copying the homework?

Governments of the two provinces have eerily similar plans to give themselves new powers to...

Over 1,000 oil and gas companies got a corporate tax break in 2022 for operating as a “small business,” according to the Canada Revenue Agency.

Nearly 30 per cent of all Canadian-controlled private corporations that extract oil and gas secured the lower corporate income tax rate for small businesses in the 2022-23 fiscal year, according to a statement from the federal agency that administers Canada’s tax laws. The agency’s statement was in response to questions posed in Parliament by Niki Ashton, the NDP’s tax fairness and inequality critic.

Companies with up to $50 million in taxable capital — a term used in accounting when calculating corporate income tax — can access a lower tax rate of nine per cent for at least a portion of their taxes, instead of having to pay the regular rate of 15 per cent, if they are not a public corporation, in other words listed on a stock exchange, and not controlled by one, or by non-residents. Taxable capital is the amount that a company’s capital exceeds its investment allowance for the year.

There are no rules banning oil and gas companies from taking advantage of this tax break — even as the country invests tens of billions of dollars toward efforts to decarbonize the economy and fight climate change, which is caused by heat-trapping pollution from burning fossil fuels.

The figures have prompted Ashton to call for more scrutiny from the revenue minister over the tax filings of oil and gas corporations.

“This is a sector that we know made money hand over fist — and increasingly, at a time when more and more Canadians are struggling, increasingly at the expense of our own goals in terms of climate action … to find out that almost 30 per cent of oil and gas [extraction] companies in Canada receive the small-business tax deductible is shocking, frankly,” Ashton said.

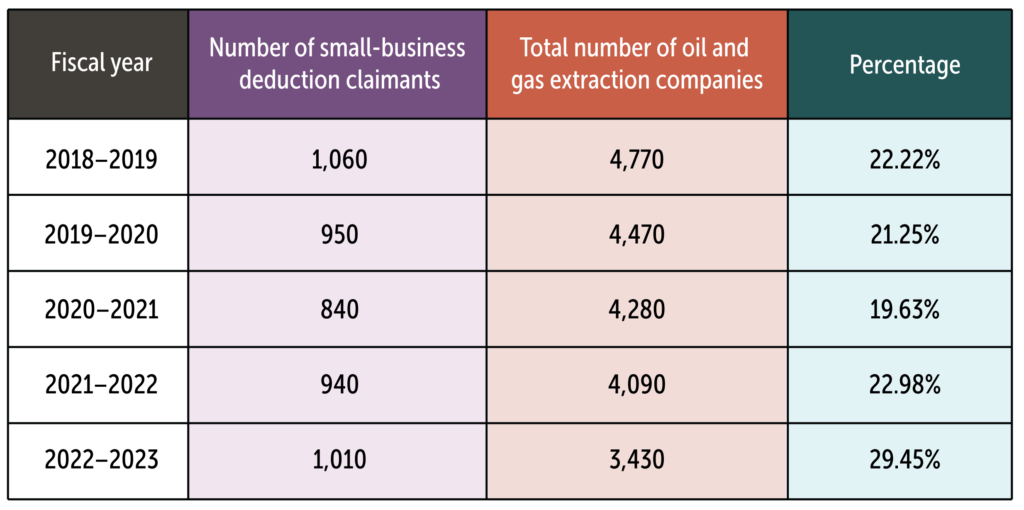

In the fiscal year 2022-23, 3,430 Canadian private companies under the industry classification of “oil and gas extraction” filed corporate income tax returns, and approximately 1,010 of them, or 29 per cent, claimed the lower tax rate for small businesses that year, according to tax agency figures.

That’s up from 940 oil and gas extraction companies that claimed the lower tax rate for small businesses in 2021-22, representing 23 per cent of the total. In 2020-21, 840 oil and gas extraction companies claimed the lower rate, representing 20 per cent of the total. (The agency said its numbers were rounded to the nearest 10, to protect the confidentiality of tax filers, and were current as of Sept. 30, 2023.)

The “oil and gas extraction” category includes companies exploring for crude oil, drilling companies, firms dealing with technology and equipment for oil and gas wells and those transporting raw, unprocessed crude near the drilling site.

Alberta was home to the highest number of such firms, with 700 claiming the rate for small businesses in that year — representing nearly 70 per cent of the national total. Saskatchewan was home to 120 small oil and gas extraction firms that year, the second-largest amount and B.C. was home to 80 such firms.

Canada collected more than $13 million from oil and gas extraction companies that claimed they were a small business in 2022-23, the agency said.

Katrina Miller, the executive director of the non-profit Canadians for Tax Fairness, said she considered oil and gas companies’ access to the tax rate for small businesses a kind of subsidy.

It’s one example of how Canada’s tax system is “unintentionally subsidizing our fossil fuel sector at a time when we’re trying to reduce our net emissions,” Miller said.

Canada made a commitment in 2009 at the G20 to eliminate “inefficient fossil fuel subsidies” by 2025. Inefficient subsidies are those that “encourage wasteful consumption,” the group said, as well as “reduce our energy security, impede investment in clean energy sources and undermine efforts to deal with the threat of climate change.”

Last year, Canada published a framework showing how it will determine which measures should be considered subsidies, and which of those should be considered “inefficient.”

But that framework discounts tariffs or duties that are applied in a “standard way” to all businesses and industries — meaning the government won’t consider lower tax rates to smaller oil and gas companies to be fossil fuel subsidies.

The Narwhal asked National Revenue Minister Marie-Claude Bibeau’s office why the minister felt the tax break for oil companies was necessary, and whether she considered it a fossil fuel subsidy. A spokesperson from the minister’s office declined to answer questions, saying the Department of Finance was “better suited to respond to your inquiry.”

The tax rate for small businesses “is not deemed an inefficient fossil fuel subsidy,” Finance Canada spokesperson Caroline Thériault confirmed in an emailed response to The Narwhal. “It is a tax measure of general application across the entire economy.”

Thériault said Canada is the “first and only country in the G20” to have phased out subsidies ahead of the 2025 deadline. She said nine tax measures were either eliminated or adjusted so they are no longer “inefficient.”

For years, questions have dogged the government about which tax measures should be defined as subsidies, and which of those should also be considered inefficient.

In 2019, for example, the government claimed its $4.5-billion purchase of the Trans Mountain oil pipeline and expansion project should not be considered a subsidy — a fact that stunned the auditor general’s office at the time.

Canada’s main oil and gas lobby group, the Canadian Association of Petroleum Producers, has said it doesn’t consider tax measures to be subsidies. Meanwhile, the Explorers and Producers Association of Canada has said it believes the production of oil and gas no longer requires government support.

In 2022, Environmental Defence Canada said it tracked $21 billion in federal fossil fuel subsidies, adding it believed this was likely an underestimate.

A February report from the House of Commons Finance Committee recommended putting an “end to the financial support of the oil and gas industry as soon as possible.”

Last summer, Environment and Climate Change Minister Steven Guilbeault held a press conference in Montreal announcing Canada had come up with a plan to tackle fossil fuel subsidies.

“We’re eliminating subsidies to produce fossil fuels in Canada, whether it’s oil, gas or coal,” the minister told the crowd.

The Narwhal asked Guilbeault’s office whether the minister thought of the lower tax rate as a fossil fuel subsidy when it was claimed by oil and gas firms. A spokesperson passed questions to Finance Canada.

The Narwhal also asked the Environment Department its view of the matter, and those questions were also passed to Finance Canada.

Miller, from Canadians for Tax Fairness, said in order to achieve a net-zero economy, Canadians need to imagine a future in which the economy is not “wrapped around the fossil fuel sector.”

“We have a number of things in our tax code right now that are meant to incentivize economic productivity … what we’re seeing, though, is that the fossil fuel sector is taking advantage of these tax [breaks],” she said.

Oil and gas extraction companies in Canada made over $63 billion in profits in 2022, according to Statistics Canada, the result of both rising production of fossil fuels and rising prices.

Miller said she was particularly struck by the fact that almost 30 per cent of oil and gas extraction firms were claiming the rate for small businesses.

She said that led her to “speculate” many of those companies “may be subsidiaries of larger corporations that certainly do not need a tax cut, and probably are very profitable right now.”

That was a key concern of Ashton, the NDP MP, who asked in the House of Commons if there were “any mechanisms or audits in place to ensure that larger oil and gas entities are not creating smaller subsidiaries primarily to benefit from the small-business tax rate.”

If there were, she asked, “how many audits or investigations related to this issue in the oil and gas sector have been initiated in the past five fiscal years?”

Creating subsidiaries to claim a lower tax rate is illegal. Under the Income Tax Act, a group of “associated corporations” is considered a single economic entity and must share the same $50-million limit when calculating if the tax break applies.

The tax agency told Ashton it does audit the rate for small businesses as part of its “regular audit process,” but it doesn’t specifically look into potential abuse by oil and gas companies.

“The [Canada Revenue Agency] does not have a specific mechanism in place to track oil and gas companies that may be misusing the [small-business rate] by creating subsidiaries,” the agency wrote in its response to Ashton.

“Additionally, the [Canada Revenue Agency] does not track audits in the manner requested by this question, as the risk is mitigated through the [agency’s] regular audit practices.”

Ashton said Bibeau should “push the [Canada Revenue Agency] to crack down on large corporations in Canada, including in the oil and gas sector, that aren’t paying their fair share,” particularly after what she called the “excessive amount of energy” the agency has employed to claw back pandemic-era relief funds from individual Canadians.

The agency has been trying to recover $4.6 billion worth of pandemic relief sent to ineligible people, resulting in individuals being hit with big tax bills after being previously approved for funding.

“It would be far more important to see that same sort of zeal applied toward going after corporations, including in the oil and gas sector, who are avoiding their fair share of taxes,” Ashton said.

A government official speaking on background said the revenue agency takes abuse of Canada’s tax system seriously, but can’t comment on information about its compliance strategies as this could jeopardize the agency’s activities.

The agency encourages the public to report suspected tax or benefits cheating, they said.

The Narwhal asked the Canadian Association of Petroleum Producers if it had any evidence of oil and gas companies creating subsidiaries to benefit from lower taxes, and why it felt there were so many oil and gas companies claiming the lower tax rate for small businesses.

A spokesperson for the organization sent a statement on behalf of the association’s president and CEO, Lisa Baiton, which said Canada’s oil and gas production sector includes a “wide range of company sizes, from small juniors to major national and international companies,” including businesses supplying goods and services to the industry.

The tax agency’s numbers relate to an industry classification for oil and gas extraction that “encompasses a broad range of activities, not all of which directly relate to the core operations of upstream exploration and production,” Baiton’s statement said.

While the “vast majority” of fossil fuel production comes from the industry’s largest players, the statement added, the petroleum association said there are just 81 such companies with more than 100 employees and 47 with more than 200 employees.

Get the inside scoop on The Narwhal’s environment and climate reporting by signing up for our free newsletter. On a warm September evening nearly 15...

Continue reading

Governments of the two provinces have eerily similar plans to give themselves new powers to...

Katzie First Nation wants BC Hydro to let more water into the Fraser region's Alouette...

Premier David Eby says new legislation won’t degrade environmental protections or Indigenous Rights. Critics warn...