With everything more expensive these days, Canadians are paying more and more attention to anything that might boost costs. That has long included carbon pricing (also known as the carbon tax, levy or whatever you want to call it).

The price on carbon has been a political punching bag for years.

That debate has long lacked nuance, but with an increasingly strained Liberal government under Mark Carney facing off against a Conservative opposition led by Pierre Poilievre that is determined to make the carbon price the central issue in the next election, the nuance has all but evaporated. NDP Leader Jagmeet Singh also opposed the Liberals’ consumer carbon pricing system, which Carney effectively removed as soon as he was sworn in as prime minister.

How did the ‘carbon tax’ work in Canada?

First of all, it isn’t technically a tax — a price or levy would be the accurate way to describe the system, but colloquially, it’s known as a “carbon tax.”

The federal government introduced a price on carbon in 2019 — the first time individuals across the country were faced with a price that impacted things like gasoline and home heating. But it wasn’t the first time industry had faced a levy, and Ottawa wasn’t the first to tack costs onto carbon pollution.

Alberta was the first jurisdiction in North America to put a price on emissions, instituting its levy on large emitters in 2007, followed shortly by Quebec. Other Canadian provinces (and some states) introduced emissions-trading systems shortly thereafter.

According to the federal government, the consumer carbon price currently added 17.6 cents to each litre of gasoline.

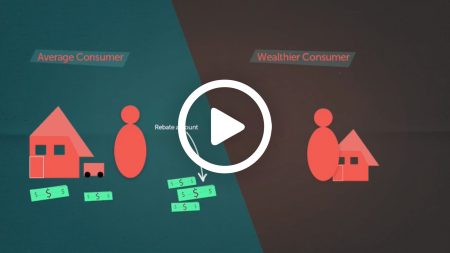

How did the carbon tax rebate work?

The costs of the carbon levies can be hard to measure, particularly as they were offset by rebates on to Canadians, paid out quarterly as the Canada Carbon Rebate. Basically, the pool of money the federal government collected through the price on carbon was redistributed to all Canadians, but the amount of that rebate varied depending on where you live, whether you’re in an urban centre and whether you have children. The basic idea being, the less money you spent through the price on carbon emissions, the more of that rebate that remained in your pocket.

So, as the carbon tax or the price on carbon went up, that rebate increased, too.

Money collected through carbon levies for industrial emitters are returned to the provinces and territories and are meant to fund greener technologies.

Why was everyone so fired up about the carbon tax?

There was much tension between the federal government and the provinces on the carbon pricing regime, particularly in Saskatchewan. There, the government even said it would stop collecting the levy on households in response to the rebates the federal government provided on home heating oil, which largely benefitted those living in Eastern Canada.

Before that, Saskatchewan, along with Manitoba and Ontario, brought a constitutional challenge of the federal carbon price to the Supreme Court of Canada. The court ruled the carbon price was valid, and underscored that it is not, in fact, a tax.

Economists say carbon pricing is the lowest cost form of regulating emissions, can be highly effective and help fund new green projects.

As a federal election looms, and with the Liberals holding on to a minority government which now lacks the guaranteed support of the NDP, it remains to be seen how much the industrial carbon price takes centre stage.

We’ll be keeping an eye on the carbon tax and how this pricing affects both people and the environment, among other stories about the natural world that matter most. Sign up for our weekly newsletter to stay informed!