What it takes to dig up the dirt in Alberta

Accessing government records in Alberta is tougher than ever. If you want to find how...

Get the inside scoop on The Narwhal’s environment and climate reporting by signing up for our free newsletter.

Will there be tariffs? Will they be 10 per cent, 25, 50? In a dizzying cycle of unrelenting news, you’d be excused for not being sure anymore.

But the latest round of tariffs could have real implications for an industry they don’t intend to target.

U.S. President Donald Trump has recently taken aim at steel (and aluminum). These new tariffs will have huge implications for the Canadian steel industry — which sends as much as 99 per cent of its exports to the U.S. — as well as a wide array of Canadian products, far beyond steel itself.

But you don’t (usually) get steel without coal. It’s all part of the complicated web of impacts of a trade war.

Here’s what you need to know as more Canadian commodities — potash made headlines last week! — get caught up in tariff impacts.

The United States has implemented 25 per cent tariffs on steel and aluminum. This is a different executive order from the one targeting all Canadian and Mexican goods that has captured Canadian’s attention for weeks. This metal-focused order was signed Feb. 10, and set the stage for tariffs on steel and aluminum imports to the U.S. beginning March 12.

In a flurry of threats this week, Trump abruptly promised to double the tariffs, meaning there would be 50 per cent tariffs on Canadian steel imported into the country. Then, just as abruptly, he backed down.

Still, as of Wednesday, 25 per cent tariffs are now in place on steel and aluminum from Canada and the rest of the world. Finance Minister Dominic LeBlanc, calling Trump’s tariffs “completely unjustified, unfair and unreasonable,” announced dollar-for-dollar counter-tariffs in response.

This is not the first time Trump has brought in tariffs like these. Tariffs on Canadian steel also went into effect in 2018 during his first administration (also 25 per cent) and were lifted in 2019.

Steel is one of the world’s most ubiquitous and important building materials, used in nearly every building, vehicle, machine, plane, ship, public transit system and bridge on the planet.

The International Energy Agency has projected global demand for steel will increase by more than a third by 2050. Steel will, in part, help build new infrastructure such as wind turbines, electric vehicles and high-speed trains in the cleaner, greener global economy envisioned to facilitate the push to net-zero carbon emissions.

But all that production comes with an enormous environmental footprint. According to the International Energy Agency, the steel and iron industry produces more carbon pollution than any other heavy industry.

The industry is responsible for between seven and nine per cent of the global emissions created from the burning of fossil fuels, according to the World Steel Association.

As much as 99 per cent of Canada’s steel exports head to the U.S., according to the International Trade Administration.

Coal — known as metallurgical coal — has long been used to manufacture steel.

The steel industry is the world’s largest industrial consumer of coal, according to the International Energy Agency.

Estimates vary, but generally one tonne of steel requires about 0.7 tonnes of coal.

Steel is an alloy — a mixture of iron and other metals. Coal is used to get pure iron, which is hard to find naturally.

No need to get your chemistry textbooks out, here’s the gist of a very technical process: coal is heated to super-high temperatures (more than 1,000 degrees celsius) to make a carbon-dense substance called coke. The coke is combined with iron ore — iron and oxygen — in what’s known as a blast furnace. So, basic heating, and then a chemical reaction that strips oxygen off the iron ore (which is way more energy intensive) — leaves you with the pure iron needed for steel.

The majority of steel is produced this way, but some companies have been experimenting with less energy-intensive techniques, like hydrogen.

Coal mines in Canada produce tens of millions of tonnes of coal annually.

More than half of that is used to make steel — 59 per cent, according to Natural Resources Canada. The remainder is what’s known as thermal coal: coal used to generate electricity.

The federal and provincial governments have moved quickly to phase out the use of thermal coal to generate electricity, signing on to agreements to phase out coal-fired electricity by 2030. Many coal-fired electricity plants have quickly switched to natural gas. But that hasn’t stopped thermal coal from being mined and shipped overseas.

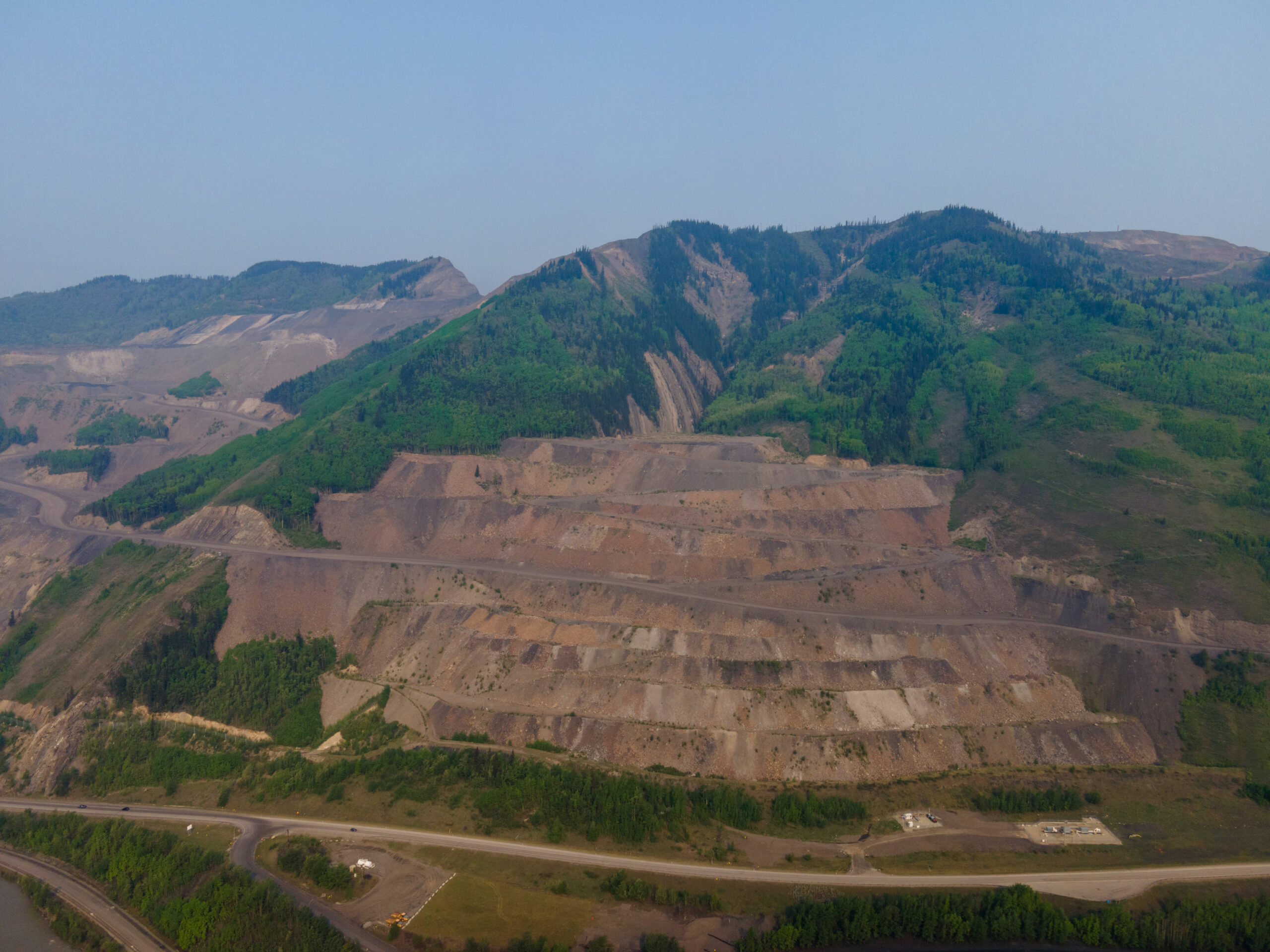

Coal is primarily a western product. According to Natural Resources Canada, British Columbia is the hotbed, home to 59 per cent of Canadian coal production. It’s followed by Alberta at just over a quarter of production. Saskatchewan contributes 13 per cent of Canadian coal production.

In B.C., the vast majority of coal — 95 per cent — is used to make steel.

According to the B.C. government, the coal industry in the province employs thousands of people and generates billions of dollars of revenue each year. The province notes that “coal production currently represents over half of the total mineral production revenues in the province.”

The B.C. government says most of its coal is shipped internationally via coal ports on the West Coast, while a smaller percentage gets shipped to steel mills in eastern Canada.

But since Trump has targeted all of Canada’s metallurgical coal customers around the world with new tariffs on steel, it remains to be seen whether their market could soon dry up.

That could leave the industry — especially in coal-reliant regions — rather exposed to a trade war.

The Canadian Steel Producers Association has recently emphasized how interconnected the U.S. and Canada steel industries are, saying there is $20 billion in annual steel trade between the two countries.

As The Globe and Mail has reported, last time Trump imposed 25 per cent steel tariffs, back in May 2018, Canadian steel exports fell by around 20 per cent (they later rebounded when the tariffs were lifted). And if steel production is decreasing, it follows that the steel industry’s consumption of coal is decreasing, too.

What will happen this time? Only time will tell. But industry advocates are ringing alarm bells.

“If we can’t get out of the tariffs, we need to hit back hard,” Catherine Cobden, president of the Canadian Steel Producers Association, told the Financial Post last month, adding the tariffs could quickly lead to a decrease in production at Canadian steel plants — and job losses.

And a decrease in steel production would almost surely impact the Canadian coal industry.

For more coverage on how tariffs are impacting natural resources and the environment around you, check out our page on Canada-U.S. relations.

Six hundred samples. Roughly 180 sites across the Canadian Arctic. And more than 3,000 microbes providing more than four trillion pieces of data on the...

Continue reading

Accessing government records in Alberta is tougher than ever. If you want to find how...

Rising waters closed highways and forced evacuations, prompting fresh criticism that the province has been...

The Sio Silica sand mine southeast of Winnipeg was proposed, then rejected, then reviewed, then...